The Emerging "Dual-Cast" Model

The Streaming Ratings Report for 27-Oct-2023

(Welcome to my weekly streaming ratings report, the single best guide to what is popular in streaming TV and what isn’t. I’m the Entertainment Strategy Guy, a former streaming executive who now analyzes business strategy in the entertainment industry. If you were forwarded this email, please subscribe to get these insights each week.)

I was deep in the data bunker all last week prepping my big article on the WGA’s success-based residual. (Find it here. I’m going to be regularly updating it over the next little bit, like I did with my “Future of Film” series, so bookmark that page.) Overall, I really enjoyed that piece of data analysis, since it was a great way to step back and look at the broader streaming landscape, compared to diving in the streaming ratings weeds each week.

That analysis wasn’t possible without streaming ratings or the streaming ratings report. Only by collecting, organizing, and analyzing all of this data week in and week out can I pull off a data dive that deep. As I’ve written before, figuring out whether a TV show is successful is why I do this. And I plan to track whether WGA-eligible TV shows and films will get the streaming residual bonus. (Will I release that analysis quarterly? Twice annually? We’ll see.)

We’ve got a pretty interesting week, including a new Prime Video superhero series, some Netflix thrillers, the Just Watch global streaming rankings, and more, but let’s start by looking at yet another new development in the streaming wars...the emerging “dual-cast” TV shows.

(Reminder: The streaming ratings report focuses on the U.S. market and compiles data from Nielsen’s weekly top ten viewership ranks, Showlabs, TV Time trend data, Samba TV household viewership, company datecdotes, and Netflix hours viewed data, Google Trends, and IMDb to determine the most popular content. While most data points are current, Nielsen’s data covers the weeks of Sep 25th to Oct 2nd.)

Television - The Emerging “Dual-Cast” Model from Paramount, Disney+ and Peacock

Long time readers know that I’m a fan of the “dual-cast” model of releasing new TV shows: releasing TV shows on both streaming and broadcast/cable simultaneously. (This idea was inspired by Patrick Crakes, another media commentator who recommends the “tri-cast” model for sports, broadcast, cable and streaming. )

This is a genuine change from past TV windows, when the flow of TV shows only went one way. At the start of the 2010s, broadcast and cable shows went to a streamer (mainly Hulu) day-after-air. In contrast, when Netflix and Prime Video started streaming originals, very few, if any, streaming shows, ever made it to a linear channel.1

But this is starting to change. Lately, we’ve seen a lot of streaming content come to broadcast and vice versa:

Paramount Global put the debut episode of Special Ops: Lioness—the latest Taylor Sheridan show—on both Paramount Channel and Paramount+. For their effort, they got 920K viewers on the first night, according to Samba TV.

Dancing with the Stars is now airing live on both ABC and Disney+, the ultimate dual-cast synergy. (I hate the word “synergy” like most people, but it’s actually accurate here.) Last season, Disney put this show exclusively on Disney+. (As a reminder, Nielsen didn’t provide ratings for this show last year, nor this year.)

On Sunday 1-Oct, Disney+ streamed Toy Story Funday Football: Atlanta Falcons vs. Jacksonville Jaguars, which used VR/AI technology to make the NFL game that was actually airing on the NFL network look like it was being played in Andy’s bedroom. I hate anecdotes, but I watched it with three kids as they ate breakfast and they liked it. (Like DWTS, we won’t get streaming ratings for this one-off.)

Both Nickelodeon and Paramount+ aired/streamed A Really Haunted Loud House. Same for Monster High 2 the week of 2-October.

Paramount also released 1883—another Sheridan show—on the Paramount Network back in June, and they also put Yellowstone on CBS proper this fall. The 1883 debut had 3.8 million viewers in its first night. And Yellowstone had 6.6 million viewers for its first episode, then averaged between 4 million and 6 million after that.

Disney gave Ms. Marvel a run on ABC for two nights in August. Nearly a million folks watched each night.

Disney’s latest Mickey Mouse Halloween special, Mickey & Friends Trick or Treats, came out on basically every Disney cable channel (Disney Channel, Disney XD, and Disney Junior), then it came to Disney+ and Hulu the next day.

While this report covers the week of 25-Sep, flashing ahead to October, CBS will also air two episodes of the new Frasier reboot, a Paramount+ Original.

Of these, the most interesting to me is Paramount finally launching a show like Special Ops: Lioness (or later Frasier) with linear support, as opposed to the reruns of Ms. Marvel, Yellowstone and 1883 on linear channels, which happened well after their initial debuts.

Looking at the trend lines, Paramount clearly sees the most value in multiple window runs of its shows. (Especially the monster ratings on CBS. Paramount has made a happy of premiering new shows not just on one channel, but multiple channels. It wouldn’t surprise me if Yellowstone continues on CBS and the Paramount Channel) Disney also seems some value in dual-casting its content, but much more sporadically.

Honestly, if I were Max, Disney+, Peacock, or Paramount+, I’d do more dual-cast releases, especially right now when the strikes have ended productions of new broadcast shows, leveraging their existing assets that the tech companies don’t have. And I wouldn’t try to split the difference by only airing two or so episodes like Andor and Frasier. Just do a full run! In particular, if a show has some signs of customer interest, but needs more awareness, a second life on broadcast or cable can help boost that awareness.

I’d add, if the legacy studios were smart, they could also pitch this as a benefit to talent that the streamers can’t match. Broadcast/cable residuals pay quite a bit more than streaming residuals. Paramount, Disney+, Max and Peacock could pitch this to talent as extra payment to show they truly do support workers.

But one last warning though: broadcast or cable can’t help shows that likely aren’t popular. The CW acquired Netflix’s cancelled Down to Earth with Zac Efron, and promptly cancelled it. Meanwhile, the former Max Original Minx showed up on Starz and its linear viewership on debut was…40K households. Obviously, that will go up with replays and streaming…but still.

Quick Notes on TV

The biggest “weekly” debut of the week was Gen V from Prime Video, a spinoff of their superhero series The Boys, a show that historically does very, very well for them. It got 6.2 million hours…which is a little lower than Amazon probably wanted. Then again, it’s a brand new TV show that came out with only three episodes in its first week. It’s branded as “from the world of The Boys”, but that’s still confusing enough that some customers might not realize that these shows are connected yet. Gen V was also the top show on Prime Video Showlabs charts, which is less surprising.

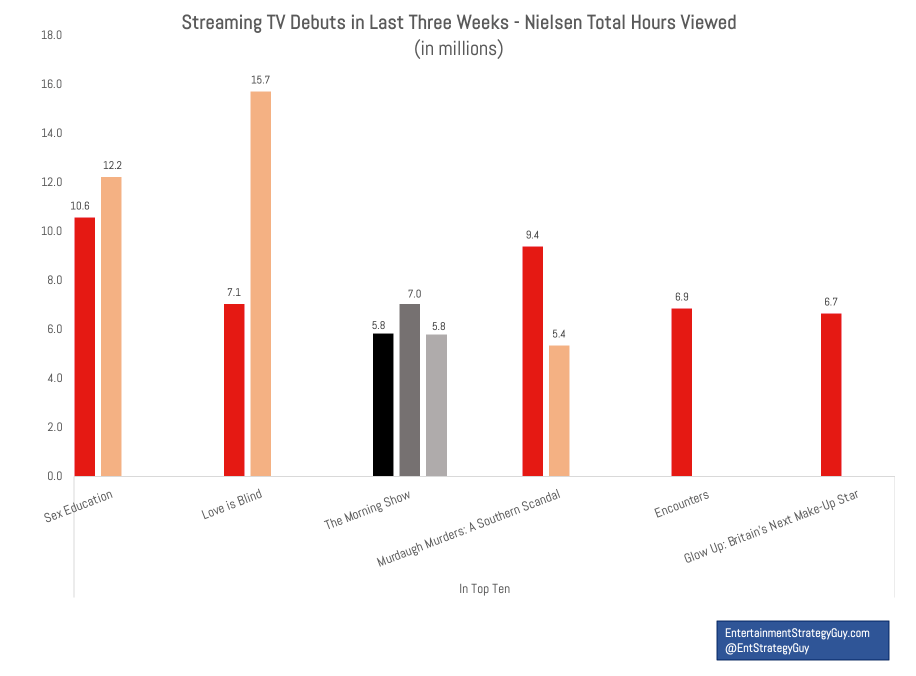

I used the word “weekly” up above, because Netflix binge-released Encounters, a new documentary series on UFOs, garnered 6.9 million hours, besting Gen V. For a documentary, that’s on the small side, but also it only had four episodes, so it’s not terrible either.

We had another strong week of NFL ratings for Thursday Night Football. Clearly, as folks migrate to streaming, more folks can find and watch TNF on Prime Video. One week of high ratings? That could be a fluke. Three weeks in a row? That’s a sign of genuine growth. Remember, this is the third week of TNF, but for the fourth week of the NFL season. (Amazon’s deal starts in week two.)