(Welcome! This is the Entertainment Strategy Guy’s weekly streaming ratings report, the single best guide to what works on streaming television and what doesn’t. If you were forwarded this email, please subscribe to get these insights each week.)

As the WGA strike finishes its second week, we really haven’t seen much movement from either side. Will we see this impact content any time soon? Probably not. As others have pointed out, some folks think the studios stocked up on completed scripts before the strike began. Plus shows take months to produce, so even if new productions can’t start, shows that are in-production and post-production will continue to wrap up their seasons.

Related to post-production timelines, I see lot of folks saying that Netflix has an advantage in this lockout because they have a pipeline of “three to six months” of content. This is both true and false. Netflix does have longest post-production timelines in the business. So while they don’t make you “wait” to watch a show, since they binge-release almost everything, they do make you “wait” those three to six extra months to watch while they finish making every episode of a TV show season.

(Though even this release strategy is slowly going away, as you can read in the “coming soon” section.)

What this means is that if the strike goes past July—which is when broadcast shows need to start filming—it will impact the traditional studios/networks first. But if the lockout lasts, say, nine months, then the traditional studios and broadcast networks will have new shows before Netflix does, like they did during the pandemic. We saw this a bit in 2021, as the other streamers had stronger starts while Netflix didn’t get some of its high profile shows until late 2021 and 2022.

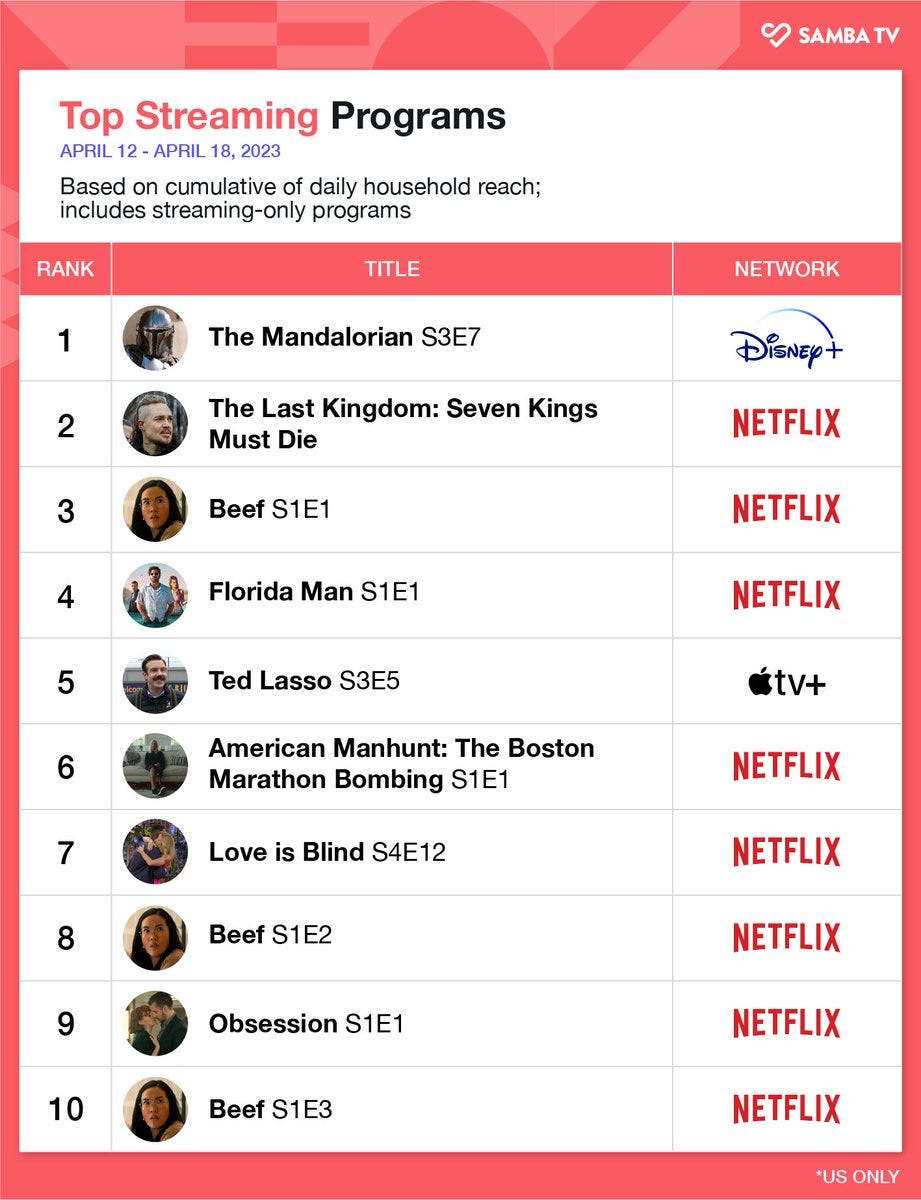

But that’s all in the future. Today is a look at the current streaming ratings. Today, I’m going to cover the return of The Marvelous Mrs. Maisel, The Last Kingdom: Seven Kings Must Die, Cocaine Bear and more.

But we start with a mini-dive into kids content…

(Reminder: The streaming ratings report focuses on the U.S. market and compiles data from Nielsen’s weekly top ten viewership ranks, ShowLabs from Plum Research, TV Time trend data, Samba TV household viewership, company datecdotes, and Netflix hours viewed data, Google Trends, and IMDb to determine the most popular content. While most data points are current, Nielsen’s data covers the weeks of April 10th to April 16th.)

Television - The Popularism “Debate” Comes for Kids TV

This week, one of the most popular TV shows in the world came back. Was it Stranger Things? Mando? House of the Dragon?

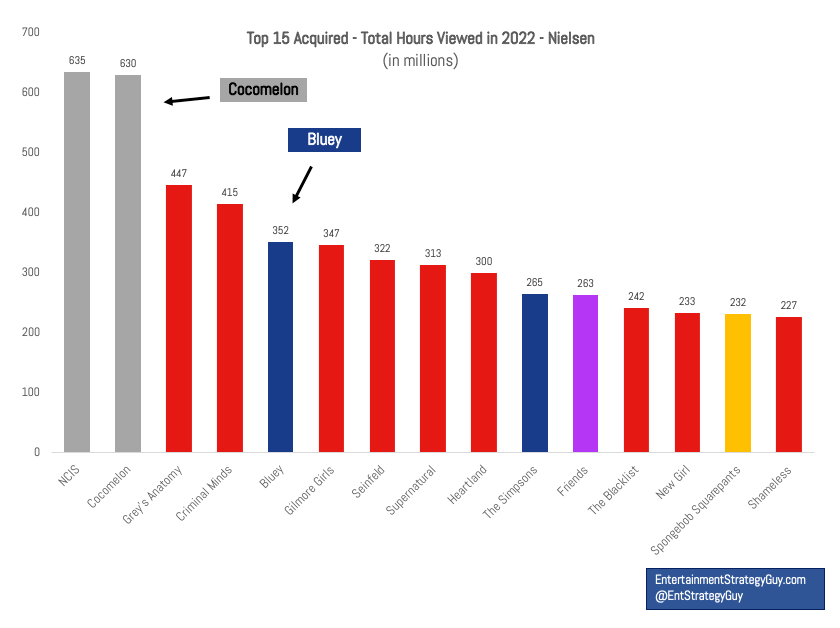

Nope, it was Cocomelon. Don’t believe me? Just check out Nielsen’s overall charts from 2022:

Of the top fifteen acquired titles, three were kids shows. Cocomelon was basically the third most popular show last year. And Bluey was the sixth, even beating Wednesday in terms of hours viewed. To be fair, Cocomelon and Bluey had episodes available all last year, and Wednesday came out at the end of November, but still, these shows are huge year in and year out.

Netflix also released a new season of The Boss Baby: Back in the Crib, which represents an interesting, but much bemoaned, shift for Netflix’s kid programming: they’re seemingly returning to licensed properties for their kids content, as opposed to original properties that they developed in house. When Netflix first got into kids content, they did a big deal with Dreamworks to fill their pipeline. But their content priorities shifted: the goal was to move out of acquired/licensed IP into their own branded stuff. They’ve since only had so-so success with that approach.

Just check out Netflix’s kids Wikipedia page:

Basically, all of the TV shows based on pre-existing IP (except for He-Man) have already been renewed. This also tracks with my (somewhat) limited Nielsen data. 1Scanning the most popular kids shows, well, most of them are based off popular pre-existing IP, like Jurassic Park, Boss Baby, Mickey Mouse, and so on. (It also shows the power of theaters to boost kids TV series. And popular kids books, like Go Dog Go! and Dr. Seuss books.)

Not everyone is happy with this shift, of course. As Yahoo bemoaned last year, Netflix once promised, to the creators of kids shows…

“unprecedented creative freedom and healthy production budgets...you could bring a project that might not have gained traction anywhere else, and suddenly have it produced, without much studio interference.”

But then Netflix changed focus again. Now they want “to make what our audience wants to see.” citing The Boss Baby as the type of show that kids want to watch. Why did Netflix want more Boss Baby-type shows? Because their viewers wanted to watch Boss Baby!

Once again, we’re back to the debate over, “Should entertainment companies make popular TV shows?” debate. (I know, it sounds absurd to debate whether people should make TV shows and movies that regular people (not critics) like to watch, but that happens a lot these days.)

Now, with kids content, I’m actually kind of conflicted about catering to kids' tastes versus making high quality, if niche, content. On the one hand, as a parent, I know what it’s like to see your kids fall in love with certain TV shows that feel like the visual equivalent of sugary cereal. I won’t name any names, but I can think of at least one TV show that, whenever my kids watch, they turn into maniacs. (And it involves JJ.)

On the other hand, like so much Hollywood content these days, well-meaning creators and critics sort of delude themselves into thinking that certain niche kids shows, especially critically acclaimed shows, are more popular than they actually are. Basically, they want the shows they like to be universally beloved, even if they aren’t. Or they believe that a promotional campaign would have convinced legions of children to watch shows that they don’t actually want to watch.

I don’t want to name anything in particular, but you probably know what kind of show I’m talking about.2 Do kids want to watch prestige, art house kids content? Maybe some small percentage of them do. But at the end of the day, do way more kids want to watch The Boss Baby? Yeah, they do.3

One final point: with both Bluey and Cocomelon, it shows that Hollywood’s obsession with exclusivity is a bit needless. All of Cocomelon is available on YouTube, where it’s basically the most popular content in the world. But it’s still Netflix’s most popular content as well. Same with Bluey, which airs on the Disney Channel as well. If Bluey does well in both places, why doesn’t Disney share more content across both platforms?4

Quick Notes on TV

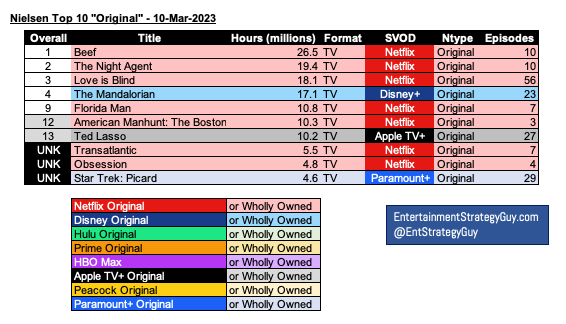

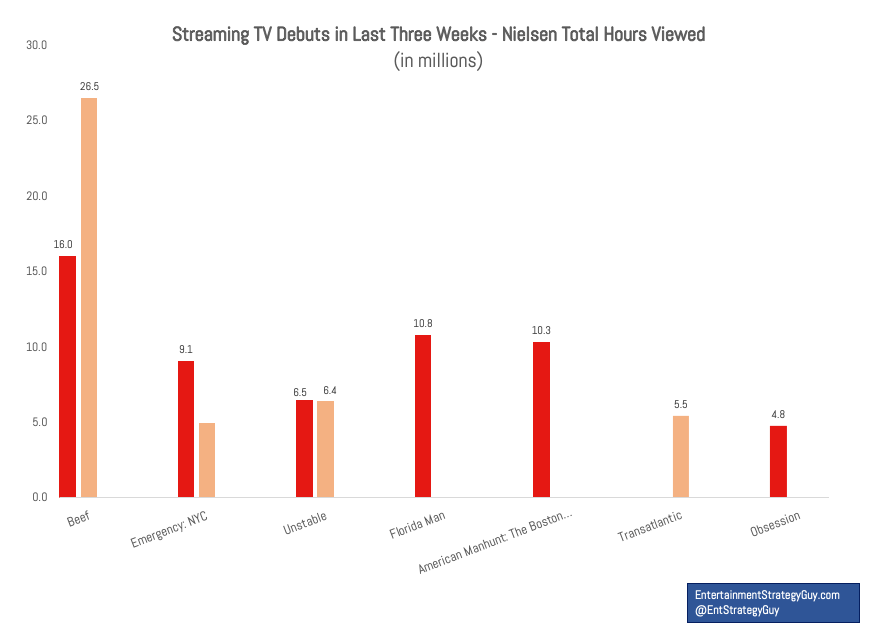

The genres of the biggest debuts of the week were not surprising if you’ve read this newsletter for any length of time: crime and true crime. On the crime side, Netflix released Florida Man, a crime thriller about a man who goes to Florida to find a girl; it debuted to 10.8 million hours in its first week. (It came out on a Thursday.) The weirdest factoid I have about this show was that, through its second week, it didn’t have a single review on Metacritic. (Even now it only has three.) Netflix also released American Manhunt: The Boston Marathon Bombing, and it’s about…you guessed it…the Boston Marathon bombing. It did remarkably similar numbers to Florida Man, debuting at 10.3 million hours, but it had one extra day to get that viewership. (It came out on a Wednesday, like most Netflix true crime docs.)

Also on Netflix was Obsession, an erotic thriller about a father who has an affair with his son’s fiancé. It only debuted to 4.8 million hours and with a 5.1 on IMDb (without a campaign) I doubt it picks up from there.

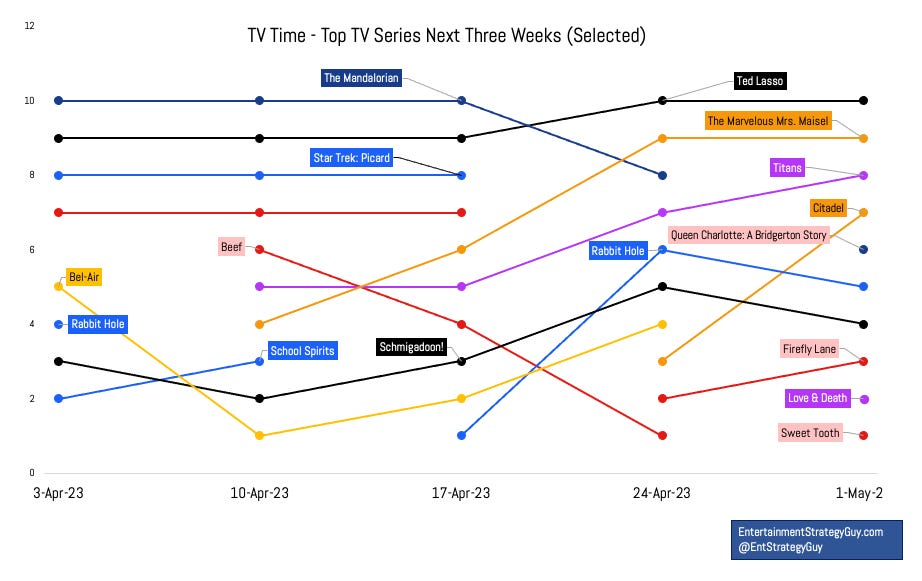

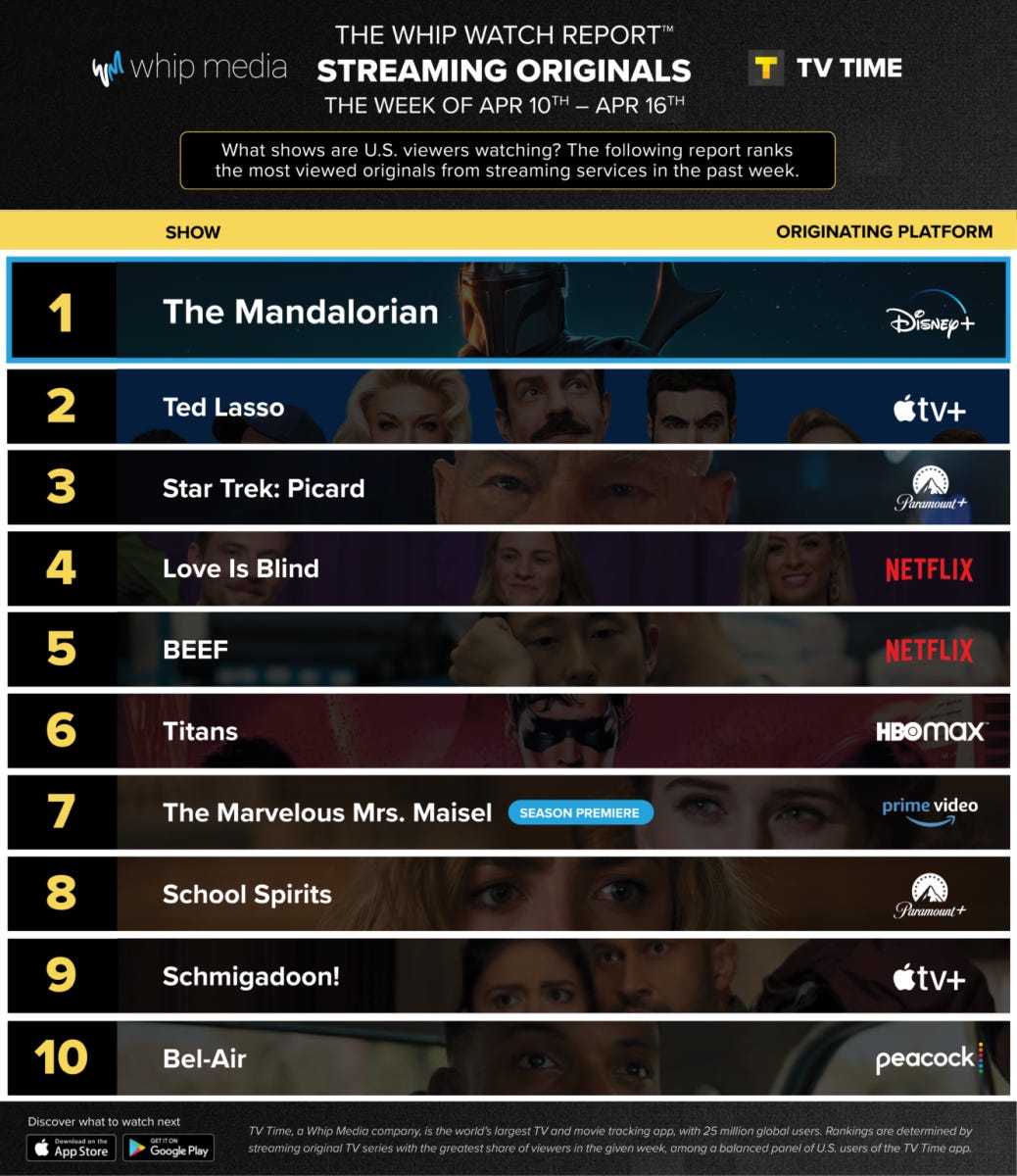

The biggest “returning” series—my term for series on the second, third or beyond season—was easily The Marvelous Mrs. Maisel, one of Prime Video’s biggest hits. Prime Video released three episodes, then the episodes went weekly. (A smart strategy!) That said, with the launch of its fifth (and final) season, the show might be showing its age, as its performance was mixed across the metrics I track. It missed the Nielsen charts in its first week, but has had a good run on TV Time, holding on for four weeks and moving up to second place on the charts. It did climb to the top of the Showlabs charts, as expected.

Looking forward, I bet Maisel makes the Nielsen charts next week. The show has elite IMDb scores (an 8.7 on 123K reviews) and you can see the the interest it has on TV Time. The previous season also made the charts for seven weeks, including debuting at 8.3 million hours. One final joke, though: Amazon still has this tag on the showpage.

I mean, that’s a weird flex, right? 2019 was a long time ago!

On HBO Max, Titans returned for the second part of its fourth season. For those who don’t know, it’s based on DC’s Teen Titans, one of the pillars of the DC comics universe. It, too, has good IMDb scores (7.5 on 106K reviews) and always does well on TV Time, though it tends to miss the ratings charts, as it missed both Nielsen and Showlabs this week. (Notably, it was a casualty of the “great Zaslav content cuts of 2022” so this is its last season. If you want to know why viewership reigns supreme over TV Time, IMDb and social media data, this is why!)

Congratulations (though tepid congrats) to Transatlantic for escaping the “dogs not barking” fate and instead merely moving into “likely a pricey miss”) territory by popping on the Nielsen charts in its second week with 5.5 million hours. Meanwhile, Star Trek: Picard is officially the first Paramount+ TV series to make the Nielsen charts for two weeks! This doesn’t really count as a record, since Paramount+ just joined the Nielsen charts in March. But still, it happened. Meanwhile, Ted Lasso has grown its ratings in its third season. Actually, the last two weeks The Mandalorian saw an uptick in the ratings as well, up to 17 million per week or so. Meanwhile, Unstable fell off after only two weeks on the charts, so it too is a miss. Beef had a big bounce into the second week. Does it have a “binge release curve” in its future?

A pretty steady week over on the “acquired” Nielsen charts, as it is most weeks. Succession continues to grow its audience on HBO Max, which matches the “datecdotes” that HBO Max has been putting out. (See the “Datecdote of the Week” below for more.)

The big, big “Dog Not Barking” of the week (reminder, this is my term for a TV show or movie that doesn’t make any of the ratings charts that I track) is Apple TV+’s The Last Thing He Told Me, a mystery show starring Jennifer Garner. At only 3K IMDb reviews, this is miles away from a hit, especially for the talent involved. It’s from Reese Witherspoon’s famed, billion-dollar-valued production company, Hello Sunshine!, and, believe me, I’ll be exploring this company and others in an upcoming article on superstar production companies and whether they’re worth their value.

Other DNBs include Freeform/Hulu’s dramedy, Single Drunk Female, which came out on Hulu the day after it premiered. When I talk about dramedies that aren’t very funny but actually kind of sad (that only a small slice of Americans, mostly critics, creatives and dev execs want to watch), this is what I’m talking about. Hulu also had the UK thriller, Am I Being Unreasonable?, but I couldn’t really figure out what it was about. And Disney+’s reality show, Rennervations, starring Jeremy Renner, debuted, but it only has four episodes, so it didn’t make the charts. (I’m guessing his accident limited production, because otherwise four episodes is not much.)

I can confirm that all of last week’s DNBs didn’t make the charts this week, including Hulu’s Tiny Beautiful Things, Paramount+’s Grease: Rise of the Pink Ladies, and Disney+/LeBron James/The SpringHill Co’s The Crossover.

Film

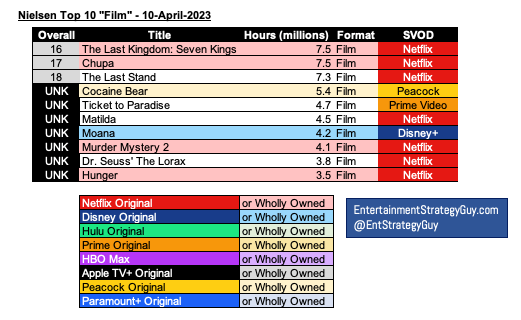

The top film this week is The Last Kingdom: Seven Kings Must Die on Netflix. I love the random little tangents that I pick up while writing about streaming ratings every week. This week, I noticed that, unlike TV shows back in the day, the titles for a bunch of Netflix TV shows and movies sound like book titles. Gone are the days where a book could simply be called Silent Spring and still entice readers to read it. Now you need an over-the-top sub-subtitle to sell it. (So Silent Spring would be “Silent Spring: How Modern Agriculture is Destroying the World Around Us and How to Stop it.”)

And this publishing trend is migrating to streaming. Netflix shows have a lot of subtitles, either to sell the film or TV series or explain what franchise it’s from. (See American Manhunt above for another example. Or “American Monster”, the Ryan Murphy serial killer mini-series.)

Any who, with 7.5 million hours, Seven Kings Must Die takes the top spot on the film charts, but that’s an idea for how weak the slate was overall. For those who don’t know—I bet a lot of my readers—this is a sequel to the TV show that’s a war/historical drama, The Last Kingdom, that's set in England. Like Obsession above, through its opening weekend this film had very, very few critical reviews (only 5 tracked on Metacritic). Customers seemed to give it a “fine” rating on IMDb, with a 6.9 on 23K reviews. It also had 1M unique households according to Samba TV through three days, which is on the low end for big Netflix debuts.

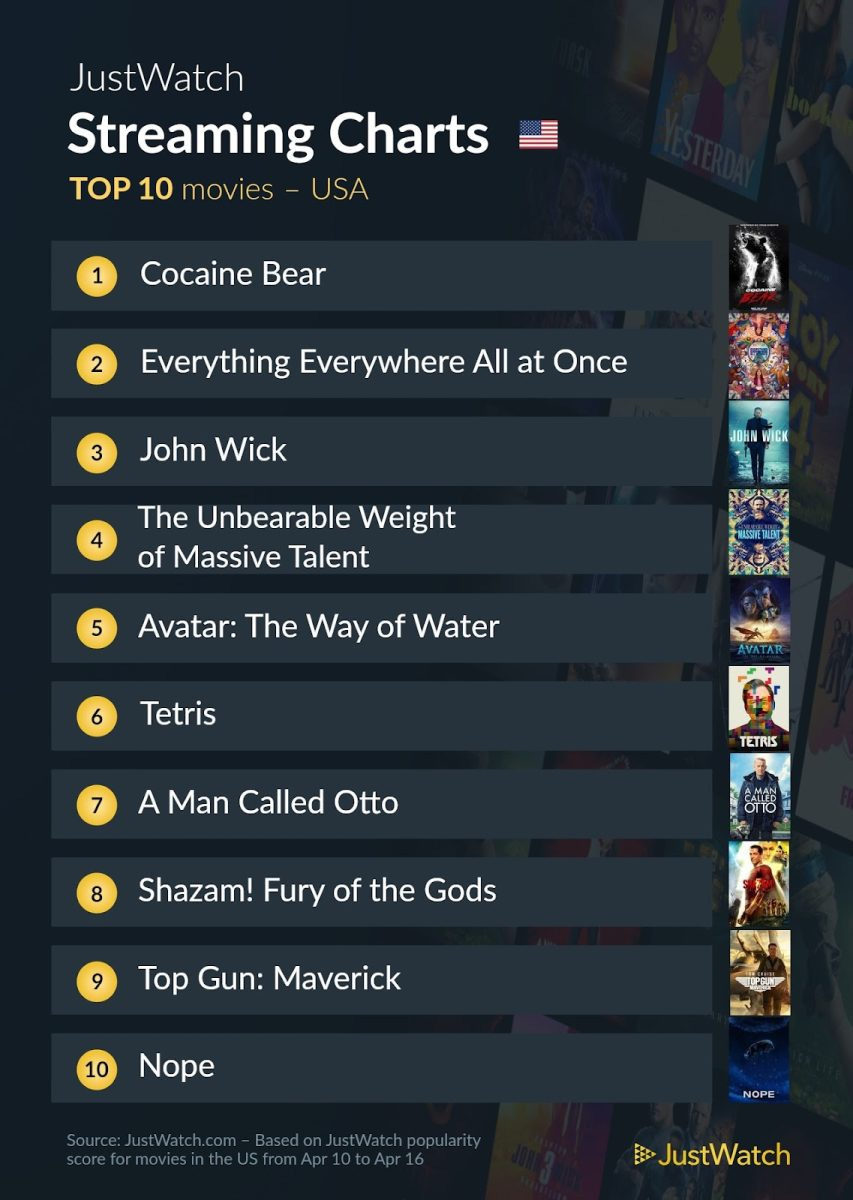

Last note: this was a Universal production, though it’s distributed on Netflix. Speaking of Universal productions, the other major release on streaming this week was Cocaine Bear. With only 5.4 million hours on Peacock, those numbers aren’t “huge”, but a reflection of both the size of Peacock (small) and the relatively niche genre It’s kind of a comedy/horror film. I mean, it’s about a bear who does cocaine! (I can’t wait to see it; my wife not so much.)

Peacock’s smaller size/users isn’t a death knell for these films either, since the lack of viewership means that, when they switch platforms, they get another viewership bump, as we saw this week with Ticket to Paradise showing up on Prime Video and promptly clocking in 4.7 million hours viewed.

Both of these films are on the smaller side with Cocaine Bear getting $64 million in domestic box office and Ticket to Paradise getting $68 million. And yeah, Seven Kings Must Die got…$0.0.

Quick Notes on Film

Also saved from the “dogs not barking” fate this week was Hunger, a film from Thailand that had 3.5 million hours in its second week of release. Again, I’m not saying foreign films have ZERO audience in the U.S….just that since Squid Game we haven’t had another Squid Game in America yet.) (Don’t make me tap the sign.)

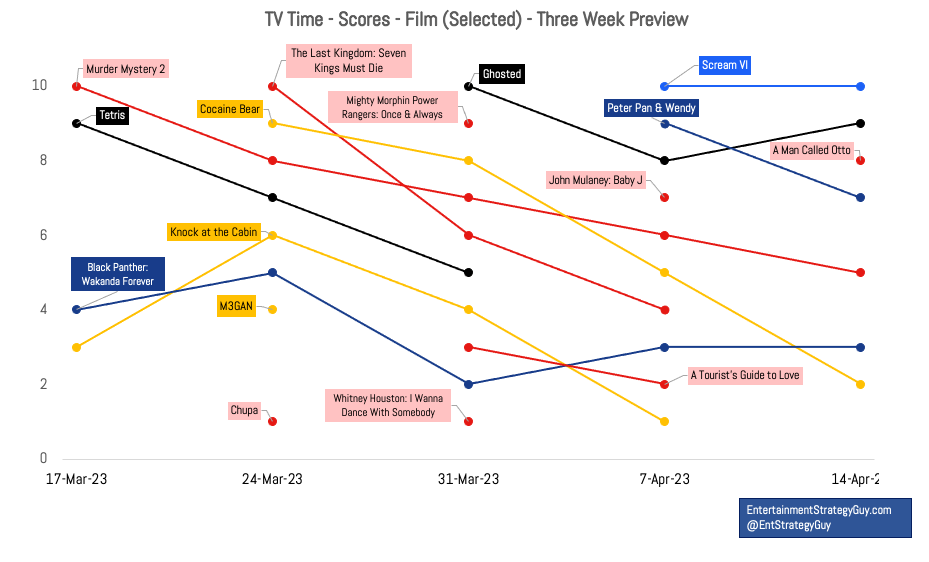

Murder Mystery 2 had another steep drop into its third week and may not last four weeks on the charts. This could be because it’s so short, but I also have a feeling that Adam Sandler films probably have ceiling on how many folks will watch.

This does contrast with TV Time, where Murder Mystery 2 has had a good run, compared to, say, The Last Kingdom: Seven Kings Must Die, which fell of fairly quickly. Cocaine Bear will have a good run too.

As a reminder, I try to cover the top twenty or so film titles on TV Time each, and I leave some movies off the chart for readability. For example, over last week, three different Guardians of the Galaxy titles showed up, but I didn’t add them to this chart to keep things clean.

The library titles were busy as always, with The Last Stand, The Hangover Part II and Dr. Seuss’ The Loraxshowing up for Netflix, Coraline, Ocean’s Eight and three Harry Potter films showing for HBO Max, and then Showlabs data for Amazon Video had the usual grab bag of titles from different streamers.

Again, it was a light week on the film side, so no true “dogs not barking”, or even huge misses. We can confirm that On a Wing and a Prayer on Prime Video missed. Three other specials missed the charts, but none were hugely expensive or notable either.

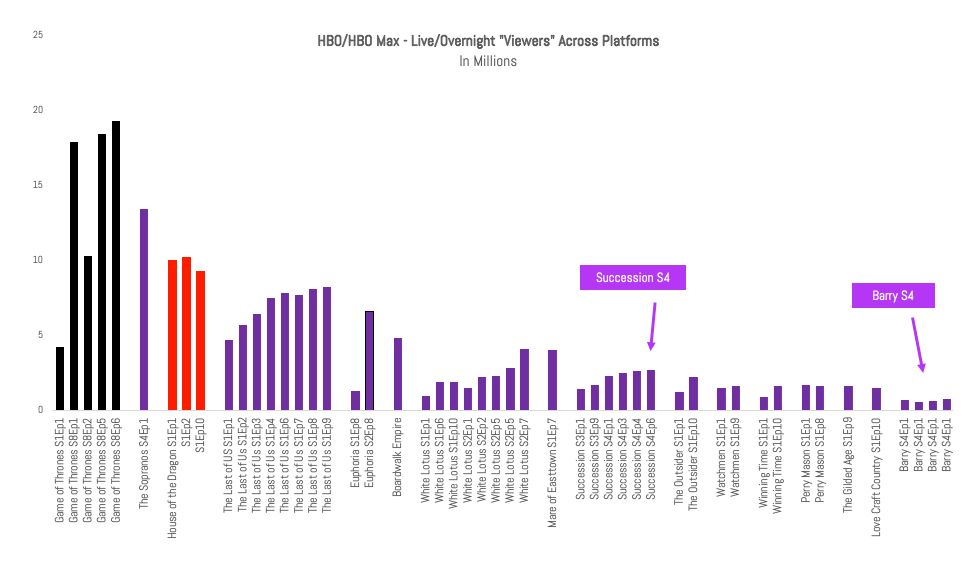

Datecdote of the Week - Succession Continues to Grow and We Get Barry Numbers

The datecdote of the week belongs to HBO Max, who has consistently decided to keep putting out datecdotes about live viewership across platforms. To be honest, they’ve put out enough that, at this point, it’s actually a robust data set. Is it as good as Netflix? Nah, but that’s okay.

The story is that Succession keeps adding about 100K viewers a week, getting to 2.7 million viewers in the first night as of episode six. We’ll see how high the finale goes.

Plus, you can see that HBO finally told us how well Barry has done this season, going from 710K viewers on the premiere up to 780K in the most recent episode.

Anecdata of the Week - Kids Content Expert Emily Horgan Reviews Netflix’s Earnings

Friend of the newsletter and kids content expert, Emily Horgan, did her rundown of kids content over on Linked-In, and since I wrote about kids content above, it felt right to give her a shout out here. In particular, I liked this chart on Netflix’s first-run, animated titles:

This quote about Netflix’s (lack of) focus on kids consumer products has not really resonated with a lot of the trade and business press, I’d add:

To me, this implies that [consumer products] is a marketing tool for the streamer. Any ambition to invest in this structure as a true business unit and revenue driver seems to be absent. And sure, there is power in kids wearing a t-shirt to demonstrate their fandom, but there needs to be a true machine behind the content if you want to have a hit.

To tie the chart and quote together, it’s also hard to launch consumer products when you don’t have huge smash hits, and when the size of the hits seems to be going down, if anything.

Coming Soon!

Next week, we find out if The Diplomat was a hit, plus virtually every streamer released a nature documentary series in the same week, to coincide with Earth day, because it makes sense for everyone to release the same type of show in the same week. Viewers only want nature docs one week a year! (Sarcasm). Also, Ghosted goes up against Whitney Houston: I Want To Dance With Somebody.

Later this month, oh man, Prime Video’s Citadel. On the plus side, it’s based on original IP, which is great. But it cost $300 million, which isn’t great. Even if it makes the charts, it needs a big debut to avoid becoming one of the misses of the year.

Long term, Netflix announced that the next season of The Witcher will come out in two batches, one batch right before the second quarter ends, and then one a month after...this doesn’t have anything to do with quarterly earnings reports, does it?

Appendix

Kids shows don’t tend to make the charts all that often, which is why I’d love if Nielsen broke kids content out separately, though I understand why they don’t. (It’s a tricky thing to define.)

One other example: critics always say that little kids love scary, terrifying kids content, which is great in theory, but do you want to stay up with my kid when she has nightmares?

Some shows do both. I think Bluey is the ur-example of what everyone should go for: terrific educational content, a unique style, plus kids love it.

Rugrats’ 2021 reboot also returned with more episodes this week, but that show hasn’t made any of the metrics I track.