Prime Video’s Straight-To-Streaming Films Were Bigger Bombs Than Red One

The Streaming Ratings Report for 27-Nov-2024

(Welcome to my weekly streaming ratings report, the single best guide to what’s popular in streaming TV and what isn’t. I’m the Entertainment Strategy Guy, a former streaming executive who now analyzes business strategy in the entertainment industry. If you were forwarded this email, please subscribe to get these insights each week.)

Luckily, it was a somewhat light week heading into the American Thanksgiving vacation. But as I wrote last issue, things are picking up again in November, as they always do…for the week of 18-Nov, I tracked 46 new films, shows or specials, the third highest since I started tracking new releases in 2022. (We’ll be back next week with a double issue.)

Before we get to this week’s issue, some interesting news: Amazon is shutting down Freevee, its ad-supported streamer, which used to be IMDb TV. Amazon is, if nothing else, tenacious about chasing (copying?) other tech companies’ successful business models, but abandoning them if they need to. I like this movie, if for no other reason than Prime Video is already way, way too complicated trying to figure out what’s included, what isn’t, what’s for rent, what’s a subscription, what requires an ad, and so on. Amazon adding advertising to all of Prime Video seemingly made Freevee superfluous anyways, but it may help to simplify their offering.

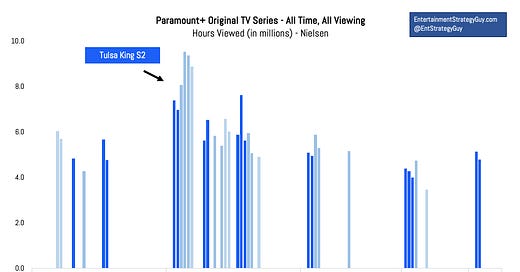

Speaking of Prime Video, their straight-to-streaming films have been bombing lately, but I don’t think anyone’s talking about it. All that plus new data on the number of TV shows last year, the lesson to take from this year’s World Series, a hit show on Paramount+ (and two flops), all the flops, bombs and misses of the year, and a whole lot more.

Let’s dive right in!

(Reminder: The streaming ratings report focuses on the U.S. market and compiles data from Nielsen’s weekly top ten viewership ranks, Luminate’s Top Ten Data, Showlabs, TV Time trend data, Samba TV household viewership, company datecdotes, and Netflix hours viewed data, Google Trends, and IMDb to determine the most popular content. While most data points are current, Nielsen’s data covers the weeks of October 21st to October 27th.)

Film - Prime Video is on a Straight-to-Streaming Losing Streak

Over the last couple of weeks, a lot of proverbial ink has been spilled about Amazon MGM/Amazon Studios’ Red One, framing it (rightly) as an expensive theatrical flop.

But where is all the ink about Amazon’s straight-to-streaming films?

For the week that this report covers, Prime Video released Canary Black, a new action film/spy thriller starring Kate Beckinsale as a “CIA agent on the run”.1 And it was the last in a string of Prime Video’s rather brutal straight-to-streaming releases, nearly all of which missed the Nielsen top ten charts or made Luminate’s chart well below anything resembling a hit. (Canary Black had 4.9 million hours according to Luminate, and anything at or below 4 million hours on Luminate is a miss.) It also missed Samba TV.

Nevertheless, if you search Google, you can’t find anyone calling this film a flop. In fact, you get the opposite:

One of those articles cited Reelgood, which is a useful interest chart, but making that list for one week doesn’t make this a hit film by any means. Also, fans didn’t seem to like Canary Black, since it scored a 5.3 on 8.2K reviews on IMDb, both bad numbers.

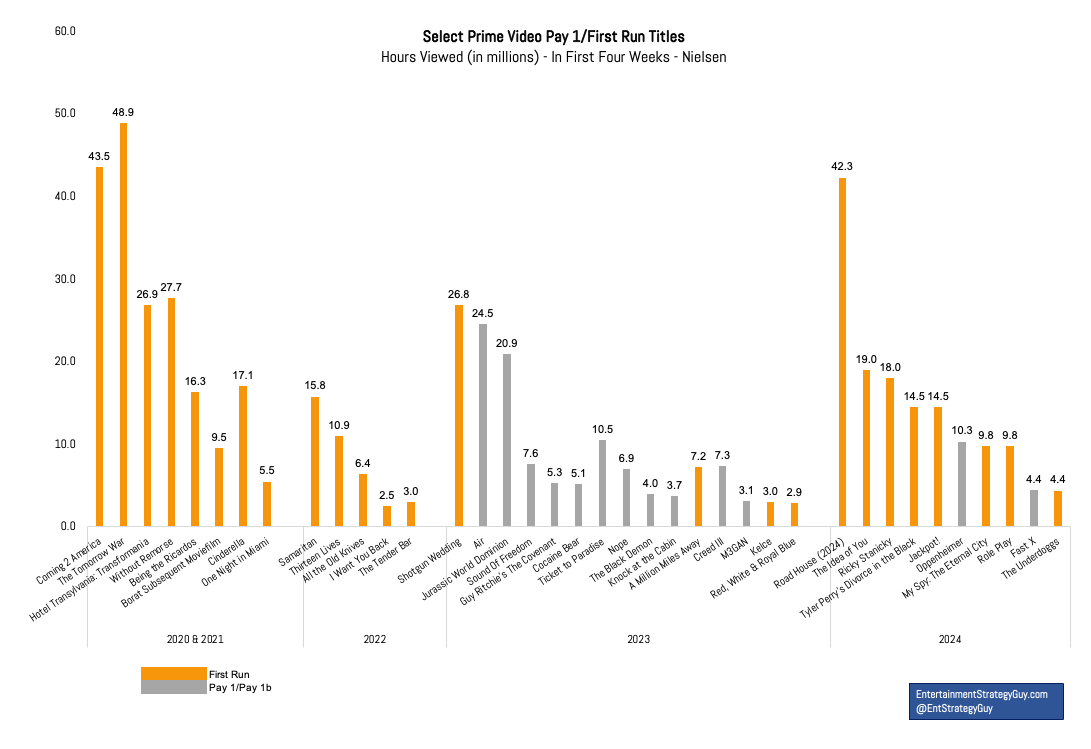

But it’s not just Canary Black. Amazon released a not-necessarily-cheap film flop every week in October, but the losing streak goes further than that: My Spy: Eternal City (Dave Bautista), One Fast Move, Jackpot! (Awkwafina and John Cena), Killer Heat (Joseph Gordon-Levitt and Shailene Woodley), House of Spoils (Ariana DeBose), Brothers (Josh Brolin, Peter Dinklage, Brendan Fraser, Glenn Close, and Marisa Tomei), and Canary Black all underwhelmed. You have to go back to Tyler Perry’s Divorce in the Black from early July to find a movie that justified its presumed budget. (Both it and Jackpot! got 14.5 million hours on the charts, which is fine for a low-budget Tyler Perry film, but not an Awkwafina/John Cena action comedy.) Two weeks before that, Space Cadet flopped.

That run of misses emphasizes some long-running themes of this weekly report:

Amazon Studio’s losing streak garnered minimal media attention for reasons that are both structural (it’s hard to identify the misses with streaming ratings compared to the very public box office numbers) and self-interested (Prime Video funds a lot of FYC ads in the trades).

If a film isn’t big enough to merit a theatrical marketing campaign, then it needs a much lower budget. Divorce in the Black and One Fast Move feel like TV movies; My Spy: The Eternal City does not.

Regardless of where you fall on the “streaming versus theaters debate”, this type of spending with such low returns likely isn’t sustainable. (Meaning, without theaters, Hollywood will make fewer films, but those films will have lower budgets.)

We don’t have Red One’s streaming data, so this analysis is incomplete, and yes, it was much more expensive than many of these films, but if you add up all these films’ budgets—many of which we don’t know—I’m not sure how far they’d be from Red One’s budget, if not higher.

Even Prime Video seems to see this logic, at least for some of its films. Red One got a full theatrical release and marketing campaign. If it hits on streaming, it might—just might—change their thinking somewhat. (Then again, the “Argylle Treatment” is powerful.2 Amazon hates bad PR, but Red One generated a lot of negative headlines since it grossed $110 globally on a $250 million budget; but if it went straight-to-streaming, that budget wouldn’t be public knowledge, and thus no negative PR.)

Listen, releasing films is a portfolio play. Prime Video’s one hit in 2024, Road House, should pay for the misses, but if you have too many outright misses and too few singles or doubles, even that one hit won’t pay for the misses. Since July, Prime Video has struggled to hit those singles and doubles, especially in the last seven months.