(Welcome to my weekly streaming ratings report, the single best guide to what’s popular in streaming TV and what isn’t. I’m the Entertainment Strategy Guy, a former streaming executive who now analyzes business strategy in the entertainment industry. If you were forwarded this email, please subscribe to get these insights each week.)

This week, I had the immense pleasure of going on Sonny Bunch’s must-listen podcast, The Bulwark Goes to Hollywood, for the third time, and we covered...everything? I’m still getting my podcasting reps in, but I felt that this was one of my best podcast recordings yet.

If you would like to have me on your podcast, I’d love to go on (time-willing), so please reach out. I’ve worked out a lot of the technical kinks to record my voice, but I’m still not able to utilize video (for obvious reasons).

Okay, on to this week’s issue, there’s a lot to discuss, including this year’s biggest box office grosser coming to streaming (will it also become this year’s top film on streaming?), a formerly destined-for-theaters film which Apple sent straight-to-streaming, Netflix’s Mr. McMahon wrestling doc and what it does and doesn't tell us about potential WWE success on Netflix, more straight-to-streaming films than we’ve had in a while, another basketball documentary miss, the WNBA’s record-breaking ratings, all the flops, bombs and misses of the week, and more.

(Reminder: The streaming ratings report focuses on the U.S. market and compiles data from Nielsen’s weekly top ten viewership ranks, Luminate’s Top Ten Data, Showlabs, TV Time trend data, Samba TV household viewership, company datecdotes, and Netflix hours viewed data, Google Trends, and IMDb to determine the most popular content. While most data points are current, Nielsen’s data covers the weeks of September 23rd to September 29th.)

Special - The NFL Has Its Best Regular Season Streaming Night, Plus Amazon Goes More “Live” Than Ever Before

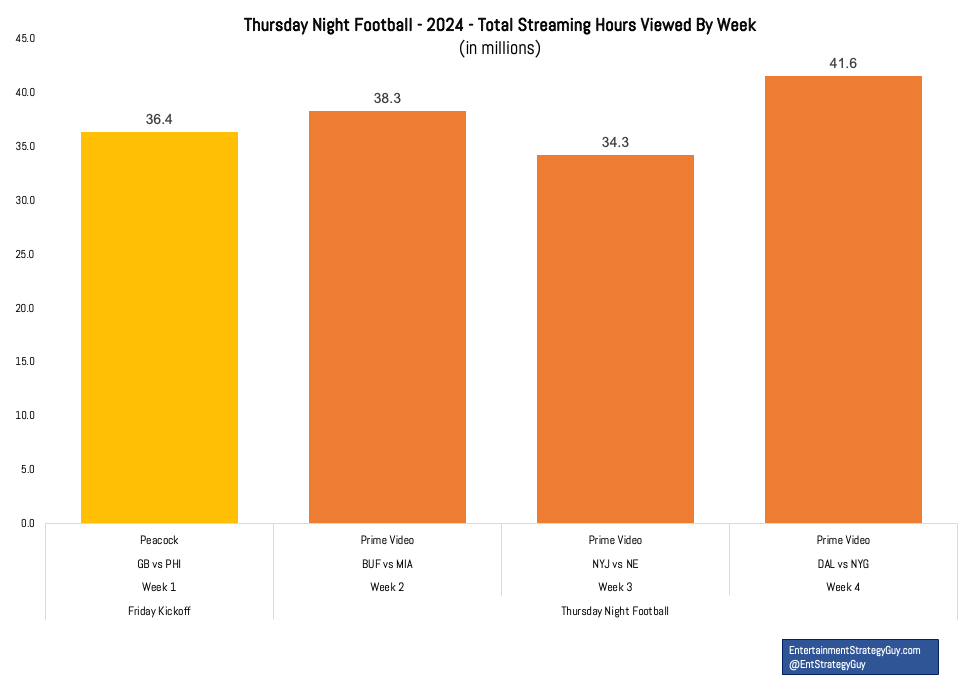

After two weeks of “meh” ratings, Amazon finally had a match-up that really delivered the goods. In week 4 of the NFL season—the showdown between the Cowboys and Giants on 26-Sep, which was Amazon’s third game of the year—hit the highest viewership total they’ve had yet on a Thursday night.

For context, let’s chart all the Thursday Night Football games over time:

That’s right. Amazon finally had a game join the “40 Million Hour” club, my unofficial club for huge streaming TV hits.

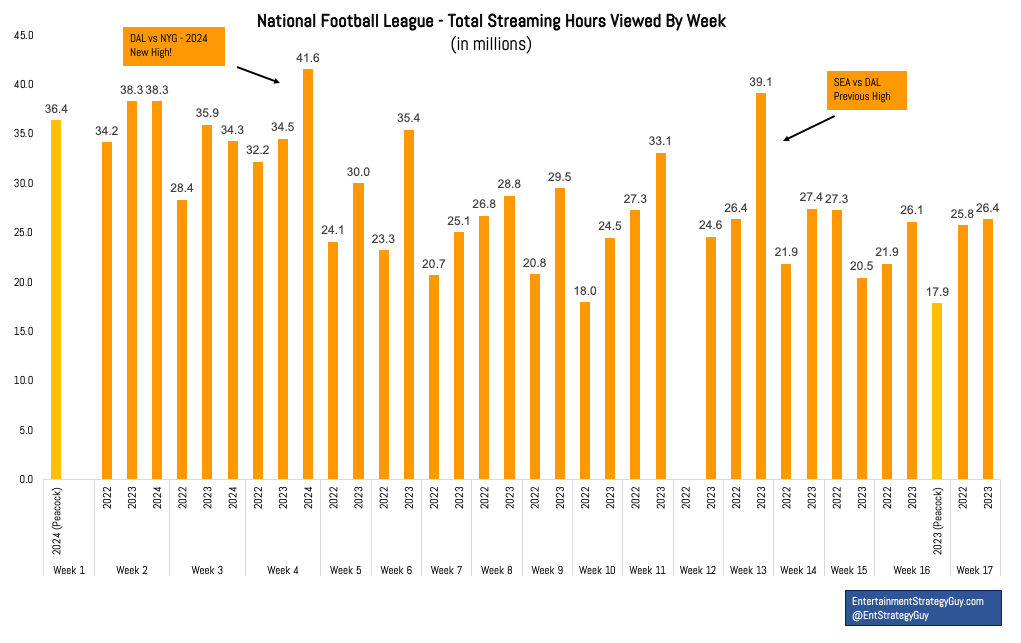

Did you notice which team played in the previous top Thursday Night Football game from last year? That’s right, the Dallas Cowboys. That week 13 game generated 39.1 million hours (again, by my calculations). In other words, this record had the caveat that any NFL game featuring the ‘Boys tends to break records.1

Nevertheless, through three games, TNF is “up” compared to past years, mostly due to this big number. I think we’ll see that trend continue, though, like past seasons, we’ll also see total viewership decline week-by-week as some meaningless games crop up later in the season. (Viewers start tuning out for games between two teams that won’t make the playoffs or that will likely be a blowout; see the second image up above.) Still, for Prime Video, I’d cautiously say this is evidence that their sports content is slowly gaining viewers over time.

Will this encourage Amazon to double down on “live content”? Seemingly so. We got word last week that Amazon will stream a live news special to cover the election.

Sonny Bunch asked me about this on his podcast, and I’m glad he did because it allowed me to opine on one of my bigger theories about streaming. Essentially, if you look at The Gauge each month, you can see that while streaming has made ground, many of the subscription streamers remain flat. And broadcast and cable no longer make up a majority of viewing…but they make up a huge chunk. A chunk likely made up of sports, lots of news and lots of lean-back TV viewing, as this chart from Hub Research shows:

The question is: which streamers will offer that functionality going forward? Or will it be free streamers like YouTube or FASTs?

That’s why this decision matters: because Prime Video is going to offer that live content to differentiate from Netflix.

Content - Taking a Look at Halloween Landing Pages for 2024

Sometimes, you write articles and think, “This will really resonate” and when you click publish, sure enough, people respond, “Wow, it is crazy that three animated films equaled three years worth of horror films' box office grosses.” Other times, you click publish and…you get a collective shoulder shrug from your readers.

That happened two years ago, when my editor/researcher spent a bunch of time collecting data on every streamer’s Halloween/horror landing pages and horror film libraries. That article did okay, at best. It went from possibly being a recurring feature (for both major holidays, Halloween and Christmas) to something I didn’t update again. (This is the beauty of the creator economy, to get non-algorithmic feedback.)

Still, I like to at least check in on the streamer’s Halloween landing pages, like I did last year, even if I don’t pull a bunch of numbers to quantify it. Here’s a quick 2024 review of the major streamers approach to Halloween:

Max (“No Sleep October”), Peacock (“Halloween Horror”), and Paramount+ (“Peak Screaming”) still have elite horror film libraries (including some family friendly content) and fun landing pages that are advertised prominently on the front of their streamer.

Disney+’s “Halloween” landing page has both a family friendly library, but they also now feature Hulu’s titles as well (if you’re signed up for both plans), which muddles the branding a bit. (My editor/researcher set up a profile for his daughter, and Disney+ recommended the 2016 The Exorcist TV show to her this weekend. And he couldn’t fix it within the app.) Related, Hulu’s landing page (“Huluween”) is doing a much better job this year putting the most popular content up top, not just their originals. Both Halloween landing pages were easy to find on the front page of the streamer.

The big update for Netflix’s Halloween landing page is a great new name, the excellent pun, “Netflix and Chills: It’s Halloween” but this landing page was not easy to find, it’s still mostly a lot of Netflix Originals, and it’s only seven lines long...but they have elite library titles now (from Paramount and Sony) including films like Scream, It: Chapter Two, Halloween and Jaws.

I had the hardest time finding Prime Video’s “Tarot-fying October” landing page, but I love the design. That said, Prime Video has the same problems as last year: it’s hard to tell what’s free and what isn’t or what comes from another streamer. Apple TV+’s “Halloween: Frights and Delights” page has the same problem, if not worse since their library is so limited. It seems like bad UX/business model to offer this combo of free and subscriptions and rentals, but that’s the challenge when a company runs multiple business models in the same user experience.

Overall, my main takeaways are the same as last year and the year before, the null hypothesis, if you will:

Library content matters and likely drives much more viewership than exclusive originals at this time of year. Customers want to watch popular horror films from popular horror franchises.

The streamers should only push popular streaming originals, emphasis on “popular”.

I would highlight these Halloween collections on the front of most streamers. From the weekend before Halloween to Halloween, it would be the first or second thing you can see.

Perhaps it doesn’t really matter. As I wrote last year:

“Paramount+ and Peacock have excellent Halloween landing pages, but they’re two of the smallest streamers out there, so is this a competitive advantage? Not really? Still, it matters to execute things like UX well. It shows which streamers are making a good effort to actually curate content for their users in a smart, user-friendly way.”

Film - Inside Out 2? Huge Hit. Wolfs? Hit for Apple TV+?

After Inside Out 2 smashed its first two weekends at the box office back in June, I wondered if this would be the biggest opening/viewership on streaming this year:

Since it’s an animated title, it is much likelier to win the “first four weeks weeks” crown, since kids tend to rewatch beloved animated titles over and over. Thus, while Inside Out 2 did indeed do very well—joining the rare 30 million hour club for films—it didn’t actually win the opening week this year, an honor that goes to...