Welcome to the Entertainment Strategy Guy Newsletter! My favorite reads, listens, socials and more to keep you informed on the business of entertainment, with the links to my recent writing on my website and elsewhere.

This newsletter was supposed to go out last week, then Netflix’s Q3 earnings report stole my focus. By the time I realized I had forgotten to send it, the week was almost over. So we’re a bit heavier on my own articles this week. If these articles have a theme, it’s “viewership data”, as I’ve been using Nielsen’s weekly top ten lists to generate additional insights into the streaming wars.

(If this email was forwarded to you, sign up to receive all future emails or follow me on Twitter, Linked-In or at my website.

The Best of the Entertainment Strategy Guy

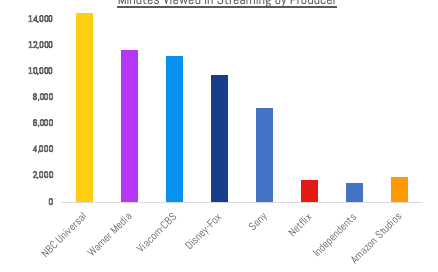

“Visual of the Week: Netflix Produces 3.3% of Its Top Streaming Shows” at my website.

The big strategic push for Netflix over the last few years has been to focus on owning the shows on its platform. Despite this push, most of the content consumed on Netflix by total minutes is still owned by traditional media companies, as I showed in this “Visual of the Week”.

“Fare Thee Well, Quibi (And What Happens Next)” at Decider

Lots of folks predicted that Quibi would eventually fold, and they were right. Quibi made three big strategic mistakes, which I explain in my latest for Decider. Plus, I speculate about where Quibi’s original content may end up now that Quibi is no more.

“Why Did Netflix Cancel ‘Away’? (Hint: The Company’s Going Through A Midlife Crisis)” at Decider

Traditional studios were walloped early by Covid-19 production shut downs, but Netflix is finally feeling the pain too. October has seen a slew of cancellations, some after only one season, which marks a change for Netflix. I explore why the seemingly popular Away got latest cancellation notice.

“What We’ve Learned from the Netflix Nielsen Viewing Stats” at Whats-On-Netflix

At the end of September, I pulled a lot of viewership data over the summer to see what was the best performing streaming content and to show how the streaming wars are increasingly competitive. I ended up with so much extra material that I just kept writing. Four of these insights on Netflix ended up at Whats-On-Netflix…

“4 Insights on Disney’s Content Strategy from the Last Summer” at my website.

…and four more ended up on my website about Disney. In short, parts of Disney’s strategy are working well (they keep launching hits; their original films are working) whereas others aren’t (Hulu).

“Visual of the Week – Netflix Top Ten Series by Total Minutes Viewed” at my website.

In preparation for the latest Netflix Earnings report, I did a “back of the envelope” calculation to see how Netflix’s top series by viewership (according to Nielsen) performed. The answer was that this second quarter, in the United States, was huge, driven by Tiger King and Ozark. As viewership drives usage, which drives subscribers, this foreshadowed Netflix’s subscriber miss in the most recent quarter.

“Most Important Story of the Week: How Google’s Antitrust Case Explain Quibi’s Demise” at my website.

As I wrote on Twitter, this idea has marinated in my head for month’s now. Essentially, the streaming wars are defined both by the disruptive strategies, and the presence of massive tech conglomerates, who don’t necessarily need a good strategy to survive. Quibi failed on the former and didn’t have the latter to sustain their losses. Here’s my look at those tradeoffs:

Read about that plus more thoughts on the Google antitrust case, HBO’s international subscribers, Netflix’s earnings and more.

“Most Important Story of the Week: Dueling Re-Orgs by Disney and Netflix” at my website.

While they are in different places in the streaming wars, both Disney and Netflix shuffled and replaced executives in October. I explain what these moves mean, while tying to figure out if they matter. Read about that plus Netflix ending free trials, Coming 2 America 2 and more.

“Most Important Story of the Week: Movie Theaters…What Comes Next?” at my website

At this point, we know that 2020 will be a historically bad year for the box office. The question is what happens to theaters after this bloodbath, in 2021 and beyond. It turns out the answers for theater chains are pretty uncertain. Read about that plus the decline in sports ratings, the Cicilline Antitrust report, Gilmore Girls to The CW and more.

Twitter Threads

I had a few good threads on social media this month. Starting with my usually deep dive into Netflix’s earnings report…

…followed by this observation about the source of most of Netflix’s licensed content.

Early in the month I also repeated my observation that The Boys has benefitted tremendously from a weekly release.

Meanwhile, the piece of “data” I wish I had most probably isn’t what you think.

The Best Content of the Last Two Weeks

(These are the best reads, listens, newsletters, or social conversations I came across last week.)

Listen of the Week - Richard Deitsch’s “Sports Media” podcast on ratings

Deitsch’s last two episodes have explored the reality behind sports ratings declines in much more depth than most of the coverage. If you want the sports ratings declines put in context (it’s both better and worse than it sounds), take a listen.

Newsletter of the Week - The Buffering Newsletter, “The Latest Front in the Streaming Wars: News” by Josef Adaliam

Adalian’s newsletter on the “streaming wars for news” is a great run down of how the traditional media players are investing heavily in news. He wisely points out that the rise of FASTs like Pluto and Tumi make this expansion a win-win for both distributors and new content producers.

Listen of the Week - “Mark Graham on Sonny Bunch’s The Bulwark Goes to Hollywood” from Sonny Bunch

This is probably somewhat self-interested since I publish regularly for Graham on Decider, but I still really enjoyed hearing his take about how Decider chooses what to publish in today’s day-and-age. Moreover, I always respect when outlets zig where others zag, and Graham describes how Decider does that in the Uber-competitive digital media landscape. For example, by focusing on under-covered/non-buzzy films and shows.

Non-Entertainment Read - “Daryl Morey Made A Lot Of Trades. How Much Did They Help The Rockets?” By Jared Dubin at FiveThirtyEight

This is a basketball article, but it uses VORP, which I’ve long advocated for the entertainment world (here and here). While the article is ostensibly about analytics, its really about decision-making, and Daryl Morey, formerly general manager of the Rockets, made more correct decisions than he did wrong. Which applies as much to business or entertainment as any industry.

(Feel free to share this free newsletter to any and everyone you want. It helps spread the word.)

(If this email was forwarded to you, and you’re wondering who I am, The Entertainment Strategy Guy writes under this pseudonym at his eponymous website. A former exec at a streaming company, he prefers writing to sending emails/attending meetings, so he launched his own website. You can follow him on Twitter or Linked-In for regular thoughts and analysis on the business, strategy and economics of the media and entertainment industry.)