The Entertainment Strategy Guide to 26-June-2020

Flywheels, Mixer's Demise, and Netflix's 63 Million Ceiling?

Welcome to the Entertainment Strategy Guy Newsletter! My favorite reads, listens, socials and more to keep you informed on the business of entertainment, with the links to my recent writing on my website and elsewhere.

Given the influx of news over the last few weeks, we have a lot to get to, and I’ll get right to it.

(If this email was forwarded to you, sign up to receive all future emails or follow me on Twitter, Linked-In or at my website.

The Best of the Entertainment Strategy Guy

Last week featured the return of my huge series asking a simple question, “Who is winning the streaming wars?” To answer, I’m using a tool from the United States Army “An Intelligence Preparation of the Battlefield”. (Read the past series here.)

My latest entry explores one of the business models driving the boom in streaming video, which is “flywheels”. In Part I, I define a host of business terms to help us explore why big tech companies (and some traditional entertainment companies) are willing to lose money to launch streamers. Part II and III are coming soon.

“Guest Column: Does Netflix Spell the Death of Superheroes?” in The Ankler

Netflix has been on a bit of a roll when it comes to “Hard R” action films. They’ve announced the “ratings” for Extraction, 6 Underground and Spenser Confidential, all as certified hits. But what does that mean as far as profitability? I answer that question using the methodology I created for the Ankler back in December to evaluate The Irishman in the latest edition of the Ankler. It turns out the production budgets matter quite a bit!

Read about my full methodology here for The Irishman and read about some implications for theaters vs streaming here. (I hope to update this series next month.)

“Most Important Story of the Week: Live Sports Rights Get Another Big Bump” at my website.

No industry was more turned upside down than live sports. Yet, now that there is a light at the end of the tunnel (even if it seems to be getting slightly farther away), the battle for live sports rights is back. The latest was a deal with the MLB by the Turner networks for another big year over year increase in price. I explain what it means and some implications for sports rights. That plus Twitter and Fortnite having good weeks, VOD data and more.

“Most Important Story of the Week: How The Card Game Uno Explains Spongebob Squarepants (Release Plan)” at my website.

Sometimes business “strategy” is really just responding to a competitor’s move with the obvious reaction. I coined the term “Uno Strategy” for that. That’s the story in theaters as coronavirus case rates grows in the United States, which keeps delaying theaters reopening. Since Tenet moved backwards again, we lost more weekends for films to try to win, so the newest Spongebob movie lost out. I explain the economics behind that move in my latest, along with thoughts on Mixer’s demise, Disney shutting Pay-TV operations in the UK, “The Netflix Effect” and more.

Quick Shout Outs

As the EntStrategyGuy brand grows, I’ve been cited in a few different outlets. Here are the latest:

- The Streaming Wars Podcast referenced my weekly column in their Roku vs HBO Max vs Amazon discussion in their episodes from early June.

- The Reel Deal website tracks which are the biggest box office bombs for 2020, wondering how well Artemis Fowl did. I’ve been asked by some if my methodology for the Irishman would work for Disney+. Not yet is the quick answer, but when I can I will.

- Finally, website State of the Screens had some info on Discovery modifying production and included a link to my thoughts on the future of TV production

Twitter Threads

I wondered on Twitter why Disney doesn’t do more with Pixar’s Inside Out, a current rewatch favorite in my household. I then answered my own question in a long thread.

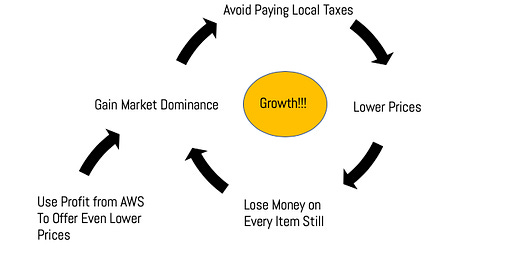

One of my favorite terms in my recent long analysis article was “Amazon’s Flywheel of Evil”. I explain it in this thread.

The Best of The Rest

(These are the best reads, listens, newsletters, or social conversations I came across last week.)

Long Read of the Week - “Mixer Failed — Here’s Why” by Bijan Stephen

I touched on Mixer’s demise in my latest column, but Stephen goes much deeper and he’s been following this world for a while. In particular, his emphasis on Microsoft failing to build a community is a point I wish I had made stronger in my commentary.

Other Long Read - “'Netflix made all the money': who gets paid for our favourite TV shows?” by Yomi Adegoke in the Guardian

Why have we seen a mini-boom in reality television on the streamers? (It’s not just Netflix, Disney+ originals have been overwhelmingly reality or documentaries.) Because they’re cheaper. In this Guardian article, Adegoke explores the world of reality TV, explaining how and why they often don’t pay talent, which is part of that “cheaper” formula.

Other Long Read - “2020 Q1 Earnings Summary” by Evolution Media Capital

WME’s investment bank has been putting out some good research and I recommend this recap of earnings season from a few weeks back. This also acts as a fairly good summary of the biggest stories of the last three months or so, even if I disagree with some of their conclusions. In particular, the potential of 5G to disrupt cable and broadband is an issue I’m monitoring.

Newsletter of the Week - The PARQOR Newsletter

I’ve gotten a few shout outs over the last few weeks in the PARQOR newsletter by friend of the website Andrew Rosen. (See here, here, here or here for examples.) However, the newsletter of his that’s been the my favorite over the last few months has been his take from April on why Netflix may have a ceiling of around 63 million customers. He comes at it from a different angle than I do, but that generally matches my past analysis. (See here for those estimates.)

Twitter Threads

Technology opinion writer Tae Kim has been doing great work recently. Recently, he explored the controversy around Apple’s fees in a long thread.

(Feel free to share this free newsletter to any and everyone you want. It helps spread the word.)

(If this email was forwarded to you, and you’re wondering who I am, The Entertainment Strategy Guy writes under this pseudonym at his eponymous website. A former exec at a streaming company, he prefers writing to sending emails/attending meetings, so he launched his own website. You can follow him on Twitter or Linked-In for regular thoughts and analysis on the business, strategy and economics of the media and entertainment industry.)