Should We Worry About a Recession? (Maybe, But Entertainment is Still in a Bad Place!)

The Most Important Story of the Week for 29-November-2022

Here’s some things that analysts, pundits, politicians, economists and journalists have predicted over the last couple of years:

At the start of Covid-19 pandemic, car manufacturers knew/predicted that a recession was coming and cut back on orders for parts, anticipating lower car sales.

Last summer, everyone assumed/predicted that we were already in a recession.

Countless political pundits told us/predicted that Dems would get wiped out in a red wave because of inflation and the economy.

After Elon Musk took over Twitter, many articles explained/predicted how Twitter would crash within days.

Quite a few analysts and economists worried/predicted that holiday spending and travel would be down, because consumers were worried about inflation and a coming recession.

Yeah, none of these predictions came true, despite countless headlines on countless major news websites, which brings me to the theme of today’s “Most Important Story of the Week” column:

Predicting the future is really hard!

Today, I’m diving deep into the economy. Are we in a recession, as nearly every headline says? What about inflation? And advertising? As should shock no one by now, I have a pretty nuanced take on all of this. And it all relates to how hard it is to predict the future.

(Tomorrow, I’ll have the rest of the headlines, including thoughts on the election and the entertainment industry, Twitter, FTX and more.)

Most Important Story of the Week - Should We Worry About a Recession?

I really enjoy the classic explanation for why recessions start, as I was taught in school.

Imagine you have a farmer named MacDonald. Each year, Old MacDonald raises a bunch of cows. (They say “moo”, by the way.) He sells these cows and buys one replacement tool, say a shovel or a hammer or something from Shopkeeper Sam. But say this year MacDonald is worried, for whatever reason, that his cows won’t sell for very much at the market. As a result, this year, he chooses not to buy a replacement shovel.

This starts a cascade of impacts. Sam employs Assistant Adam as his sales associate. With the loss in sales, Sam can’t afford to keep Adam on payroll, so he has to lay him off. Since Adam got fired, he can’t afford to replace his old roof as he planned. Then Roofer Ralph loses a sale, so he doesn’t buy a new car from Car Salesman Carl. And so on and so on. Add it up, and if enough folks pull back on economic activity, boom, you have a recession. Literally, all it takes is enough folks to simply spend 1% less than they did the year prior and you have a recession.

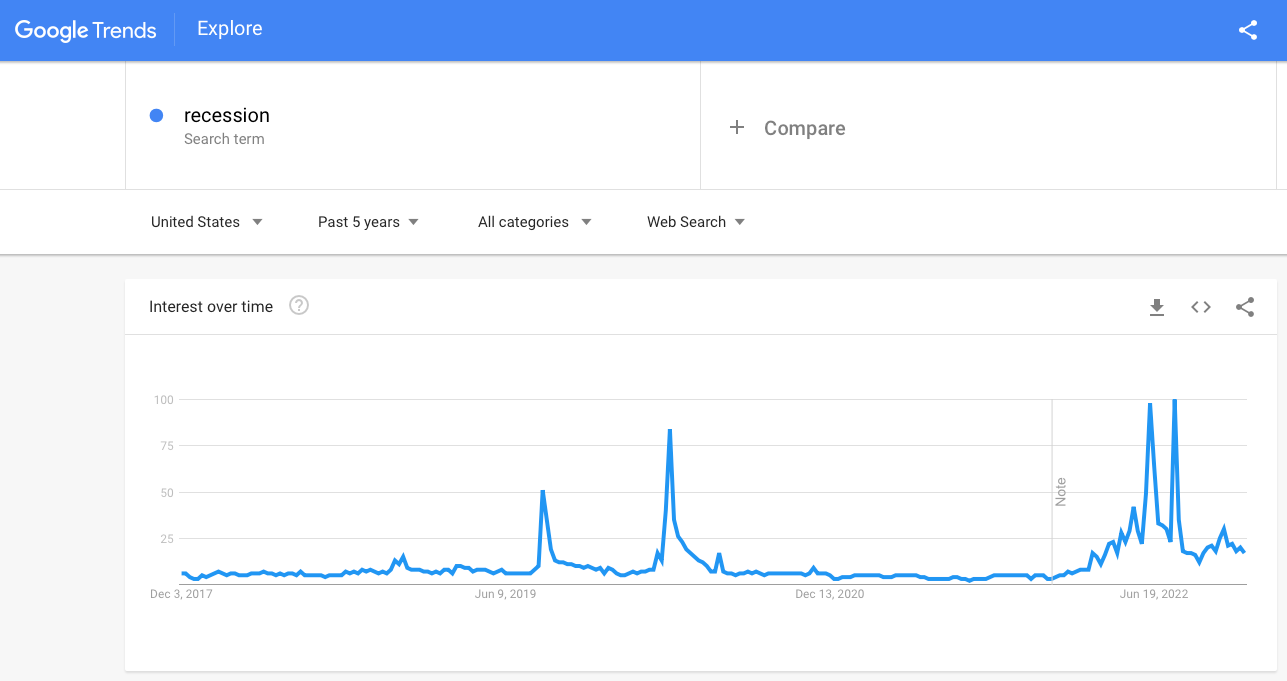

Note, a lot of the assumptions depend on the psychology of the markets and business world. If enough folks think or worry a recession will happen, then that worrying by itself, creates the recession folks worried about in the first place. And this year we’ve been worrying about this:

Clearly, folks are worried about a recession. But is that the chicken or the egg? Were folks worried about a recession, so media outlets wrote about it…or do media outlets worry about recession and then pass that on to their readers?

Plus, thanks to social media, everything is turned up to 11. We’re not just overly confident we’re in a recession, but convinced it will be an apocalyptically bad recession. Because every thing nowadays is either the “best ever” or the “worst ever”, with no middle ground.

Today, I won't predict whether we are in a recession, or will be in one soon. That alone is a fairly shocking non-prediction! Everyone is predicting that we are already in a recession. (Or worrying so much about a recession it may as well be a prediction.) Since we’re very bad at predicting recessions, I’m just going to run through the evidence and (very tentatively) the potential impacts on the entertainment industry.

(Caveat: I’m not an economist, but business leaders sort of have to have takes on the economic environment. But we should acknowledge how difficult this is. Stay humble!)

Predictions Are Tough (Especially in Economics)

Don’t trust me on this one, just ask Nate Silver. Here’s a quote from The Signal and the Noise (from chapter 6):

“Instead, economic forecasts are blunt instruments at best, rarely being able to anticipate economic turning points more than a few months in advance. Fairly often, in fact, these forecasts have failed to “predict” recessions even once they were already under way: a majority of economists did not think we were in one when the three most recent recessions, in 1990, 2001 and 2007 were later determined to have begun.”

Nate Silver’s entire chapter reveals just how hard it is for economists to actually forecast economic growth or decline.

Indeed, earlier this year, we just saw this in action, as I mentioned in the introduction. A lot of economists, analysts and pundits were worried that we were already in a recession. There were tons of headlines on it. Tons of social media retweets. Tons of talking head pieces of cable news. NPR’s Planet Money had a podcast on it, basically asking why we hadn’t declared a recession already.

Then Q3 came along and the economy actually grew!

Here’s Kevin Drum’s chart on it:

Economists don’t have a great track record at predicting economic activity. And if economists can’t do it well, then journalists probably can’t do it much better either. That goes for talking heads on cable news as well.

And I’d extend this to business leaders. And I have a real world example of this, too, as I mentioned in the introduction. At the start of Covid-19, all of the carmakers knew what was coming: a decline in automobile sales. This was an economic forecast, and as such, nearly all car manufacturers lowered orders for supplies, especially including semiconductor microchips.

Were they right?

No!

Instead, all the lack of spending meant consumers had a lot of cash and wanted to buy cars. As such, car prices went through the roof. If one carmaker had bucked the trend and taken their excess cash and doubled, or tripled their car production/semiconductor orders, they’d have cleaned up. Instead of having no inventory, they’d be outselling their competition as car prices went through the roof.

But car companies all pulled back at the same time, anticipating a collapse in car prices, but the opposite happened. And yes, maybe the car companies were secretly happy at the boom in prices (and hence profits) but the point is they got it wrong. Predicting the future is tough!

When we start talking about a recession, we should start with this humility, that we really have a tough time making economic forecasts. But two things make the current climate slightly different, starting with inflation.

Inflation: How Worried Should We Be?

The biggest economic story of 2022 is the giant leap in inflation. A lot of folks want to pretend like they saw a huge increase in inflation coming, and a lot of folks cite Harvard economist and former Treasury Secretary Larry Summers as a person who “called it” on inflation.

But most folks missed it, partly because there had been many previous predictions of impending inflation doom that never came true, from some of the most respected economists in the world, mind you, like the team at the Federal Reserve! The “Boy Who Cried Inflation” if you will. Again, economists are fairly inaccurate in forecasting, so many people were skeptical that this time their predictions about inflation would come true.

Now that inflation is officially happening, we still have predictions to make. And heaping doses of uncertainty.

For example, how long will inflation last? Because if it’s already begun to abate, then the Federal Reserve shouldn’t keep raising rates so aggressively. For my money, I love Kevin Drum’s charts of month-over-month growth of inflation, and they really look like inflation has already been tamed:

(He has other good takes here or here.)

I mean, if Kevin Drum’s analysis is right—and he’s just one person—then inflation peaked in January, and has been trending down ever since. The problem had been solved! But the Federal Reserve kept raising rates at their last meeting, meaning they think inflation will keep rising. (Some members of the Fed board now want to slow future interest rate hikes, but even this may be too slow.)

Unfortunately, the main cure to inflation is causing a recession, a process that’s already begun.

If We’re In a Recession, It’s (So Far) A Mild One

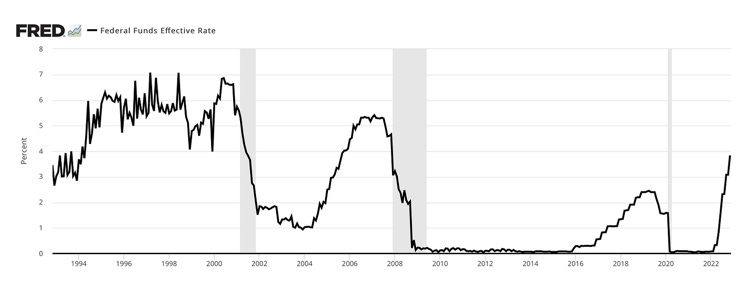

To combat inflation, the Federal Reserve Bank of the United States raised interest rates aggressively all year. Historically, high interest rates tamp down business investment, which decreases economic activity, which stops inflation. But “decreasing economic activity” is code for “cause a recession”.

Note that the Fed isn’t trying to cause a recession. They’re trying to both tamp down inflation by lowering consumer demand without causing economic contraction, called a “soft landing”. The trouble is soft landings are rare in the economic history. Usually, rate hikes lead to recessions.

Recessions are bad for lots of reasons, but the main one is they spread human misery. Remember that: A recession means that people suffer. Never forget the human cost.

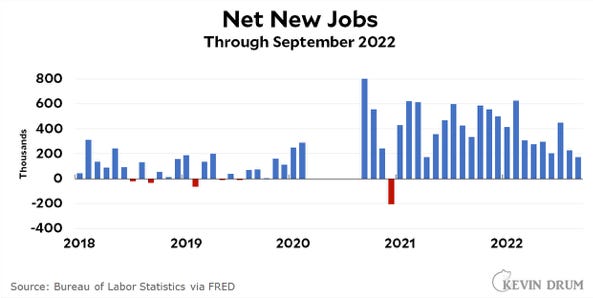

The only good news is that, so far, these measures haven’t yet had a large impact on the economy. If we’re in a recession, we’re not in it yet. Start with the best news: unemployment!

Specifically, people lose their jobs, then they lose their shelter and food, and then they suffer. That’s why we don’t want recessions! So far unemployment hasn’t increased.

The other reason I’m still optimistic that, if we are in a recession, it will be a light one, is that we just had great holiday sales numbers. Now all year-over-year comparisons need to be adjusted for the boost in inflation, but initial numbers say that retail had a great Black Friday/Cyber Monday. More folks were in stores for Black Friday than ever before. One estimate had it up 2%, but Mastercard has it up 12% year-over-year, not counting for inflation! That’s a great sign a recession hasn’t happened yet.

In general, inflation really hasn’t stopped consumer spending, as spending overall is flat but way up in certain categories. Despite constant price increases, spending and attendance at theme parks and concerts is up. Vacation spending is up too. Clearly, pent up demand for live events is still being unleashed. And for what it is worth—as a reminder economists aren’t good at this—the World Bank just forecast economic growth across the world in 2023.

But, but, but…

There Are Some Worrying Signs for Both the Entertainment and Tech Sectors

It’s not all good news for the economy.

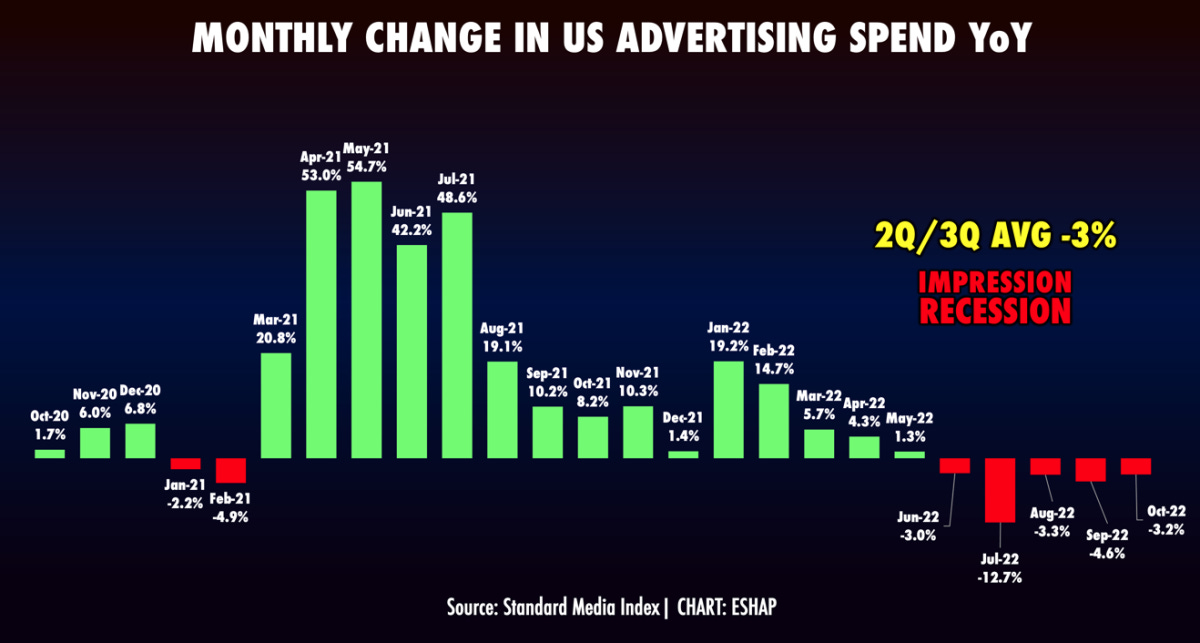

Let’s start with advertising: yes, we are in an “advertising recession”, even though there is no official government body to declare one. From Evan Shapiro’s blog:

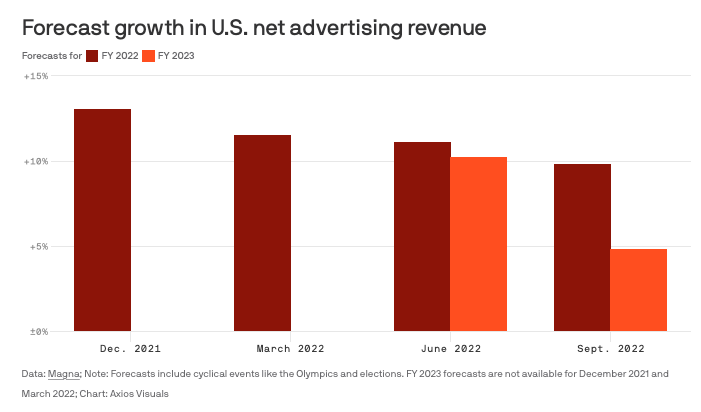

Axios has more grim news on 2023 advertising forecasts:

Yeah, that’s pretty stark. Marketing spending is fairly discretionary, meaning it's one of the first line items to go when a recession hits. To continue the analogy from the introduction, cutting back on marketing spend is the equivalent of Old MacDonald not buying his shovel.

As a result, we’re seeing suffering for everyone who depends on advertising, which means Big Tech platforms (like Google and Facebook) and entertainment (everyone basically). They all had poor earnings reports in Q3, in some cases because everyone is predicting poor end of year performance.

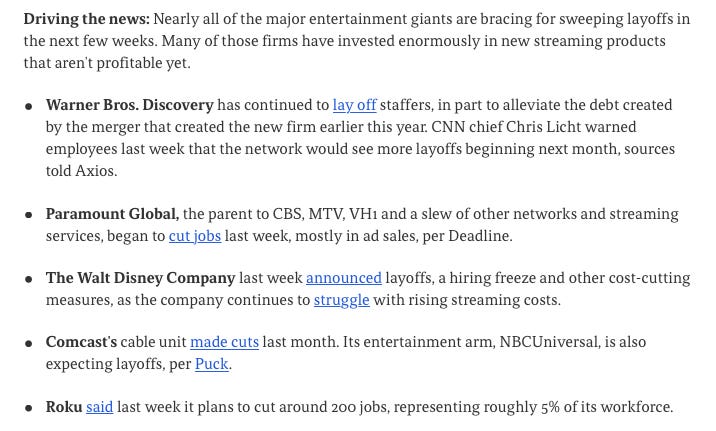

This resulted in job losses across entertainment and social platforms. Here’s a run down by Axios:

And this is the analogy continued! With a lot of laid off workers, and higher interest rates discouraging new companies to form, you have a recipe for a recession. And that’s the key question now, whether or not the advertising recession acts as a larger contagion across the economy.

And I won’t predict what happens either way. The advertising and layoff data are bad, but the rest of the economy so far has seen very positive numbers. I can’t predict either way.

Entertainment’s Biggest Problems Existed Before The Recession Worries

Now, if you work in the entertainment industry, should you worry about the future?

Yes!

But not because of the economy, but because of industry-wide choices. The biggest issue for entertainment is that three of their major revenue streams look severely impacted going forward: theatrical releases, transactional-video-on-demand (think pay per view or renting/buying on iTunes/Amazon) and linear TV. Theatrical revenue hasn’t recovered from the pandemic—and Thanksgiving weekend didn’t help—and linear TV is under pressure from cord cutting.

Meanwhile, the replacement for those three revenue streams—subscription video on demand/streaming—doesn’t make as much money or have the growth rates that most investors and business leaders assumed as of 2019. (Not to toot my own horn, but I tried to warn about this back then…)

That’s why nearly all the streamers are losing money and even the most profitable pure streamer (Netflix) still only makes chump change compared to historic cable revenues. Those factors would have hurt all of entertainment’s valuations regardless of a possible recession. It’s just that 2022 is the year where slowing growth and growing financial losses became obvious to Wall Street, starting with Netflix and continuing to traditional entertainment.

In this context, the advertising recession is simply a double-whammy entertainment didn’t need. At all. It makes the current disruption that much worse. But even if the economy were booming, the transition in business models would have caused pain (and maybe lay offs) either way. Growth would have slowed at some point.

End of the Day? We May Be In a Recession…

If you take nothing else away from this article, just be more skeptical of every economic headline you read. I stumbled on this quote recently and just whoo-boy:

“GEOFFREY CROWTHER, editor of The Economist from 1938 to 1956, used to advise young journalists to “simplify, then exaggerate”.

That describes economic journalism in a nutshell!

The more confident the headline forecasting a recession, the less trust to put in it. If you’re a business leader wondering, “Well, who do I trust then?” I mean, yeah, the experts. But listen to the experts who don’t write viral headlines (like news outlets) and focus on the experts who emphasize the probabilities.

If I had one last piece of advice, it’s to be flexible. If the entire industry is wrong about a possible recession, then the firm who realizes it first can stand to profit the most. When the herd is headed one way (off a cliff?) the lone outliers stand to benefit. (Again, look at the car analogy.)

And even if a recession is imminent, I have the same advice as always: focus on your strategy. Worry less about Wall Street, worry less about the economy, and develop a competitive strategy that focuses on your strengths. Strategy is focus and good strategy always wins.