Is Hello Sunshine the Next Maker Studios or Pluto TV?

The Most Important Story of the Week - 9-August-2021

- Private equity group Blackstone bought Reese Witherspoon’s production company Hello Sunshine for $500 in cash at a $900 million valuation.

- The best analogy to this deal is Maker Studios, another big payday for a “next generation media company” that failed to deliver on its high payday, leaving Disney “holding the bag”.

- By traditional financial metrics, Hello Sunshine is valued at 7-14 times revenue, which is historically very, very expensive.

- The biggest factor in these sky high prices is the boom in scripted film and TV production.

When news broke that Hello Sunshine sold to private equity group Blackstone for $900 million, three words hit my head:

“holding the bag”.

In that someone would be left holding the bag here.

As soon as I said it, I realized I didn’t know the phrase’s origin, so I looked it up. (In today’s day-and-age, you can never be too careful.) Originating in the 18th century, it quickly came to mean the last person holding a bag of worthless goods, potentially with criminal overtones. In stock terms, it’s the term for whoever is left when a bubble pops.

Does this mean I think there could be a bubble to pop here? Absolutely. Read on for the details.

(This week's column went long on one topic. I'll have "other contenders for most important story" in a future article.)

Most Important Story of the Week - Private Equity Group Blackstone Buys Hello Sunshine for $900

Previously, I handled business development for a streamer. “Biz Dev” can change meanings in different companies, but mine was closer to the more standard definition--often a synonym for sales--but it also meant looking for strategic partnerships or acquisitions. Which meant I got pitched quite a bit.

Along the way I met a character endemic to many industries, but especially tech, “the habitual founder”. The Habitual Founder has usually founded one company, sold it for a high price, then, with their newfound wealth and connections, build/launches new companies with their own seed money. All of which is well and good, but the crazy part was how they would pitch their success to me:

I sold my first company for a 10x return!

How did that company do? Frankly, it didn’t matter. The point was they sold it. Often, I’d look it up later and found out that the acquirer got left holding the bag on a company they wildly overpaid for, sometimes writing down hundreds of millions of dollars.

The Habitual Founder doesn’t talk about that, though. They emphasize the 10x return. Which felt crazy to me. If you sold a company to a giant entertainment conglomerate, who later wrote down the cost of the acquisition, how is that good for me and my giant entertainment conglomerate? Imagine a three card monte dealer telling you that they fleeced the shirt off the last guy, then asking if you want to pick a card.

Sometimes, the Habitual Founder even becomes a celebrity. Take Shark Tank. Kevin “Mr. Wonderful” O’Leary’s biggest claim to fame is selling his education company to Mattel, which later wrote down the entire thing. The sale of $4.2 billion still makes lists of the worst acquisitions of all time. Mark Cuban started Spotify before Spotify. Specifically, he co-founded internet radio company Broadcast.com, which was purchased by Yahoo for $5.7 billion and later shut down. In other words, Cuban’s greatest foresight wasn’t founding Spotify, but selling a later worthless website (before the dot com crash) and plowing the earnings into the Dallas Mavericks (and now other investments).

Which brings us to Hello Sunshine, Reese Witherspoon’s production company which recently sold to Blackstone, a Private Equity group, for a price of $500 million dollars and an imputed value of $900 million. (Meaning those left with shares were valued at $900 million, but Blackstone didn’t pay that full amount.) That feels like a lot for a production company with limited revenue and a small library. And it is.

But here's the crazy thing: I still think that Blackstone and maybe Witherspoon and backers will make a profit on this deal. How can both these things be true? Let’s dig in.

Holding the Bag versus Exits

The official name for “holding the bag” is the “greater fool theory”, meaning investments where the goal is to flip it later for a higher price, which is the engine behind bubbles throughout time. One isn’t investing in value, but investing in expectation that prices will keep going up.

Take the habitual founder/Cuban/O’Leery deals from above. At some point, the venture capitalists backing the companies had probably overpaid. (Both broadcast.com and The Learning Company were losing money, a big warning sign.) Which meant the quest was on for an “exit”, which is often delivered via some big, multi-billion dollar conglomerate. When the assets turn out to be worthless, the big conglomerate writes the entire thing down. So they end up holding the bag.

In other words, one person’s “exit” is another person’s “holding the bag”.

This isn’t the case in every deal. Sometimes, both sides walk away happy, each having generated value for the other. But the focus for venture capitalist investors and private equity funders (and increasingly founders themselves) is not predicated on creating value. It’s about delivering a return to their fund investors, usually within a very limited 3-5 year window. That pressure for a return drives lots of behavior/actions by both VCs and PE funds.

Past Entertainment “Holding the Bags” and “Exits”

I wouldn’t say entertainment is “littered” with examples of folks left holding the bag, but with enough larger corporations always looking to do deals, it happens every so often.

My favorite recent example is the MCN boom.

“Multi-channel networks” were collections of creator-owned Youtube channel that combined forces to increase their power on Youtube. Examples include Rooster Teeth (sold to Fullscreen), Machinima (sale to Warner Bros) and Awesome TV (sale to Verizon, valued at $650 million). Interestingly, two of those companies were later flipped for lower prices to other studios (Machinima merged with Fullscreen and was shut down, and Awesomeness sold to Viacom for $50 million).

But the king of the MCN sales was Maker Studios.

Disney purchased Maker for $500 million, with incentives to reach over a $1 billion if performance targets were hit. The performance targets were not hit. If that sounds familiar to the Hello Sunshine deal above, it should: Kevin Mayer was the architect of both deals!

To be fair, though, not all acquisitions go wrong. The most recent example are the “FASTs”, or free, ad-supported, streaming TV services like Pluto TV (sold to ViacomCBS), Tubi (sold to NuFox) and Xumo (sold to Comcast). Arguably Pluto TV is the new growth engine for ViacomCBS and Fox is planning on leveraging Tubi quite a bit in the future.

Not every sale is a home run. And not every acquisition is an inevitable write down. But in entertainment, the latter feels more likely than the former. (I left out Disney buying Club Penguin and half of Vice, and Fox buying Myspace!)

The Key Question: Does Hello Sunshine/Kevin Mayer Have a “Next Generation Media Company” or an Exit Plan?

If you listen to Hello Sunshine’s founders or Kevin Mayer, far from seeking an exit, this is about building a “next generation media company”. Ignore the high price, focus on the opportunities.

To “steel man” this opportunity, the basic upsides seems to be that Reese Witherspoon has a devoted fan base, and thus can monetize this fanbase at hitherto unseen levels. As Matt Belloni notes, Kevin Mayer and company repeatedly call this a “Next Generation Media Company”.

I go the other way. Instead of focusing on the potential “disruption”, I focus on the PE side and what they probably see. The PE folks saw the price Amazon paid for MGM (from another private equity group) and thought…

There is a soaring demand for content. From all the streamers and traditional platforms.

IP is the limited variable. And still buzzy.

Star creators have the cache to get into and pitch any streamer.

MGM just sold for multiples above its revenue/EBITDA projections.

Since PE has lots of cash to deploy—for reasons too complicated for this newsletter—if they seen an opportunity they need to go for it. I can imagine the power point presentation saying, “Hey, if we add in LeBron, Reese Witherspoon, Ron Howard and maybe A24, we can flip this to some studios/streamers desperate for content and convince them that the sum is greater than its parts.” (Belloni notes that Blackstone has about $2 billion set aside for this plan.)

The goal is to get out before the content bubble pops.

The Content Bubble

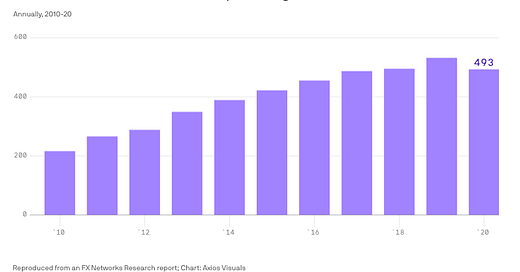

The key fact of our current times is the boom in production across TV and film. We happen to be in an age with all the broadcast and cable companies need TV shows, film studios still have full theatrical slates, and streamers are trying to compete with both. As FX research has laid out numerous times, we’re in Peak TV (via Axios):

Source: Axios.

Into that boom steps private production companies to feed the new studios and the old conglomerates. The question is, “Is this a bubble or is this high growth?” The latter will slow down and is sustainable, the former will crash and pop.

(By the by, if this is a bubble, and at some point productions are cut 25-50%, Los Angeles will be the most heavily hit, followed by below-the-line workers and then talent.)

My gut is that the PE folks (I almost said boys because it really is a good old boys club, but I’ll be generous) think they can buy a few companies, pitch “disruption”, “synergy”, “platform” and “new models” and get out before this burst.

Don’t Bet Against Private Equity

As a rule, I don’t bet against Private Equity firms. The PE guys are frankly the Petyr “Little Finger” Baelish of the finance world. To quote Game of Thrones, “He could rub two coins together and breed a third.” To continue the analogy, both PE and Peter Baelish are shady (at best) and crooks (at worst), mainly concerned with enriching themselves then building long term value. (Baelish arguably drove the Baratheon dynasty into debt, to get super-nerd-deep into ASOIAF references.)

(And I’m kidding about the PE guys. Kind of.)

PE firms do have a knack for making money. They have a lot of fancy tools at their disposal and usually the fierce desire to deliver a return to investors.

Which is why I don’t bet against them. If they see a path to generating a return, via financial engineering, tax strategies, cost cutting, or flipping assets to someone else, they’ll do it. Very rarely are they the “greater fool”. Most recently, everyone thought the hedged funds behind MGM were never going to make it. Instead, they flipped the assets to Amazon.

The Valuation is Too Damn High

Professor Scott Galloway started a new feature for his ever-expanding empire, a “Chart of the Week” newsletter. The first one couldn’t be more perfect:

The lesson? Stocks that are over-priced tend to fall back to reality.

According to The Information, Hello Sunshine’s total revenue last year as $65 million, and may be up to $125 million this year. The former is 13.8x sales and the former is 7.2. In other words, right at that point where it is very, very overpriced. Worse, a production company can have wild swings in revenue simply based on how many shows they have in production at one time.

When in doubt, fall back on the oldest problem solving tool, Occam’s Razor. The simplest explanation is best. Do you believe the wildly complicated analysis of a “next generation media company” that will disrupt the future…or believe that some smart PE guys think they can buy a few production companies and flip them to the greater fool down the line?

When someone is left holding the bag, it usually it isn’t the PE guys.

(Sign up for my newsletter to get all my columns, streaming ratings reports, and articles in your inbox.)