Free Is More Popular Than Not Free…and Other Lessons We’re Relearning in the Streaming Wars

The Streaming Ratings Report for 7-July-21

Sometimes, in a midst of lots of disruption, we—the proverbial we being “society”, “business analysts” or just people on Twitter—forget that as much as things change, they mostly stay the same.

That’s the lesson for today. Two lessons actually. While streaming ratings use new terminology, the business principles underlying them haven’t really changed that much.

(Reminder: The streaming ratings report compiles data from Nielsen’s weekly top ten viewership ranks, Netflix datecdotes, Top Ten lists, Google Trends and IMDb to determine the most popular content. While most data points are current, Nielsen’s data covers the weeks of May 31st to June 6th.)

Film

If you want the most fundamental principle of economics, it is hard to beat this picture:

The idea is that the lower the price of a given good, the more of it a company will sell. That’s micro-economics 101. Maybe something even lower than 101.

That story played out this week—meaning the week of May 31st—when Raya and the Last Dragon left the comforting confines of Disney’s “Premiere Access” program on June 4th. The boost in viewership directly matched the decline in price—going from $30 a la carte to included in the $4-8 subscription fee—as you can see here:

Given the conversation online, some folks find this boost a bit incredible. And really a “3x” increase is good! But how good? Well, I have no idea.

(I know, I know. I should deliver more grand pronouncements. Nothing’s more quotable than pundits who confidently know everything. I just wish reality complied with such simplicity.)

To start, this is a single data point. Raya is Disney’s first kids, animated film that was released on PVOD and then came to SVOD. Soul and Luca were both released straight-to-streaming, so we can compare all those SVOD launches, but it isn’t quite apples-to-apples. Even if you include Disney’s live-action Mulan, a sample size of 2 is still much too small to draw conclusions.

Second, and more importantly, we have no context for this. We don’t have (publicly available) ratings for premium cable, streaming or even basic cable viewership for past Disney films. I know this seems crazy, but Disney didn’t release The Princess and the Frog, Brave and Frozen (to name just three examples) to theaters and then bury them in a vault until Disney+ was born. Each cycled through streaming (like Netflix), premiere cable (like Epix) and basic cable (like Freeform or the Disney Channel). Not to mention home entertainment. (Folks forget about Redbox too!) Without any firm data, comparing the boost in viewership between past windows is impossible.

The one thing we know is that as each window gets cheaper, consumption goes up along with it. (More folks watch theatrical films at home, to this day, than ever saw them in theaters.)

Still maybe we can extract some lessons for streaming? Focusing only on Disney+ film releases…

I’d say that clearly animated films from the premiere animation studio of all-time remain Disney’s bread and butter. The top films on this list are Soul and Raya and the Last Dragon. My gut is that Luca easily joins this list. My working hypothesis is that Disney animation (with Pixar) have such consistently high “hit rates” that families (and many adults) will watch every Disney feature with their kids, whereas adult films—meaning intended for adults, not you know, porn—are still evaluated on the “Are folks saying this is good?” test. Mulan didn’t really pass that test.

Speaking of those two films, we’ll also see going forward the trends on the “multiple” of SVOD openings to PVOD openings. (Multiple being SVOD debut (free for Disney+ subscribers) divided by PVOD debut ($30 extra charge for select films). For Raya that’s 18 million hours divided by 5.9 million hours, so “3x”.

When Mulan transitioned to the front of the Disney+ SVOD paywall, it failed to make the Nielsen top ten. (Nielsen hadn’t expanded to three top ten lists yet. If they had, likely we would have seen how much now free viewership it generated. But knowing that the lowest viewed TV series on the list only got 10.5 million hours, clearly Mulan was below that threshold. Meaning at best, going from PVOD to SVOD generated a multiple of “1” to Raya’s multiple of three. When Cruella’s debuts on SVOD—though we’ll have to wait about four months for that—we will see if Mulan was typical or an outlier.

(There is also the chance that Mulan benefitted from peak “stuck at home during Covid and this is the first theatrical film from Disney to break the window” buzz that inflated its opening weekend on PVOD. But we’ll need lots more data to prove that hypothesis. Mulan actually did appear on the Nielsen top ten charts in early January, about four weeks after it premiered on SVOD.)

To close this out, it is worth comparing the top film charts. Raya’s SVOD debut was good enough to make the “top 8” opening weekends by total viewership:

As I’ve noted before, while Netflix dominates overall viewership, the top films are fairly well spaced between the streamers.

Quick Notes on Film

- Six of the 10 films in Nielsen ratings this week are either family or kids fare explicitly. Two more are are close calls (2 Hearts and Cruella). In a dream world, Nielsen (or Netflix) would provide us with “unique viewers” in addition to total viewership. The former biases towards content watched by adults, while the latter biases towards content viewed by kids (and viewed again, and again and again by kids). We’re really seeing that in the data with all these family friendly titles.

Television

In all that’s old is new again, here’s a lesson we’ve relearned for the streaming wars:

In television, less popular content is cancelled more frequently than popular content.

Again, in the age of the “algorithm”, some speculated that Netflix had eliminated such a need for things like ratings. Some celebrated analysts to this day opine that, actually, Netflix would rather have lowly rated shows that “retain” customers than popular shows that don’t.

Sigh.

No, Netflix—and its streaming brethren—would still rather have wildly popular shows. Because that’s why people subscribe. (To be nuanced, content is one very important factor among many, including price, habit, user experience, brand identity and more.)

Take this headline from Deadline:

This move shouldn’t have come as a surprise since these series were, guess what, lowly rated. The Crew, for example, only lasted two weeks on the Nielsen Top Ten lists. Country Comfort only lasted 1 week. Mr. Iglesias didn’t break into the top ten last year when its last season debuted. And Bonding’s second season didn’t even crack the expanded top ten lists when it debuted in January of this year. Meaning with two seasons, it generated fewer than 3.1 million hours in its debut week. Arguably these are four of the worst performing series for Netflix in the last year. So rightly they were cancelled.

This begs the question, “Does Netflix have a comedy problem?” Maybe. The biggest counter argument to this would be that I’m comparing half-hour series to hour dramas. Which is unfair to half-hours because, definitionally, they’re half as long! It’s right there in the name! “Half.”

This is why I created the “Viewership per Available Hour” metric. It’s fairly simple: I divide total viewership by the amount of hours of a series that is available. (That’s the complicated math of multiplying the number of episodes by the average length. The trick? Gotta track that average length for all 400+ data points Nielsen has provided…)

When running Netflix’s recently released sitcoms through this new metric, do they skyrocket up the charts? Hardly. The Crew was the 34th biggest debut. Using VPAH, it only climbs to 30th. For Country Comfort, it was the 38th highest debut of season 1s using viewership per day. Moving to VPHA, it only climbed to…38th!

Because Netflix binge releases their series, they don’t benefit as much from VPAH. When it comes to performance in the binge, the biggest driver is still “series completion”. If shows aren’t good, it doesn’t matter if you can binge them, because folks just stop watching after one or two episodes.

Is there an example of a series that has bucked this trend? That really benefits from “viewership per adjusted hour”?

Absolutely: WandaVision.

According to the data, WandaVision ranked in total viewership at 25th and 28th in viewership per day. But then it leaps 3rd place in “viewership per adjusted hour”. The only conclusion is that lots of folks were checking out a small number of episodes. I’d add I could have made the same point by looking at Bridgeton, what seems to be clearly Netflix’s most popular scripted season 1 since March of 2020. It too stays high no matter how you slice the data because frankly EVERYONE was watching it.

The moral is that Netflix hasn’t had a hit sitcom since March of 2020. They probably do have a comedy problem.

Quick Notes on TV

- Netflix Premiere Sweet Tooth: Netflix’s latest foray into graphic novel adaptation hit the service on June 4th and debuted to 13.2 million hours, good enough to beat Jupiter’s Legacy and Shadow and Bone. Sweet Tooth looks like it will have a good run based on Netflix’s top ten rankings (with scores of 69, 63 and 51 in June), but will fall behind Manifest, which is on track to be a ratings monster. (That show will hold onto the top spot on the US top ten list for three straight weeks at least.)

- Welcome back Downton Abbey! I say “back” because in the early 2010s this series would have dominated the streaming ratings charts and was heavily binged/bid on between the various streamers. It is currently airing on Prime Video and Peacock, and on June 2nd, Netflix added it too, which likely helped boost it to the “top ten” acquired titles list. (The film, I’d add, is on HBO Max.)

- Speaking of new additions, Dirty John’s latest season also hit Netflix and made the top ten acquired titles. Like Start Up, The Baker and the Beauty and Manifest, it has been performing—based on the top ten data—more like an “Original” than a “library” title.

- Lastly, Orange is the New Black is back too! This is a fun entry, because while it is an “original”, in my classification it is a “second run” title, meaning it’s been between a year and two years since it was first released. (The final season debuted in July 2019.) It joins The Crown and The Great British Baking Show as the functional equivalents of “syndicated” titles for Netflix now. Which is a good thing to have for retention for customers, since they don’t cost extra money, but still generate eyeballs. That’s efficient.

Coming Soon!

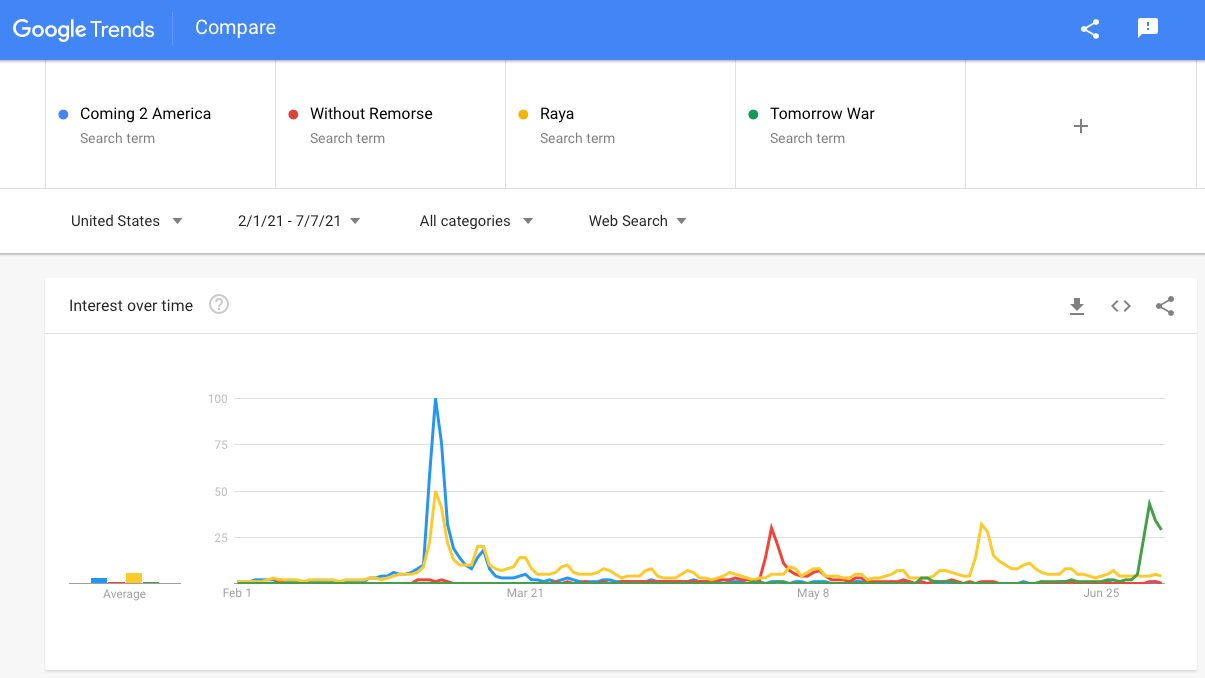

- On July 4th, The Tomorrow War premiered straight to Prime Video, the latest theatrical (and Paramount produced) film to earn this achievement, following the Borat sequel, Coming 2 America and Without Remorse. (Of these four films, all except Borat were produced by Paramount.)

So are its prospects good? About as good as Without Remorse:

- This week, today actually, we’ll also see the latest non-MCU Disney+ original, Monsters at Work, based on the Pixar Monsters Inc franchise. A topic I plan to explore soon is the fairly anemic performance of non-MCU/Star Wars series on Disney+. To date, we haven’t seen a kids title—like The Mighty Ducks: Game Changers, High School Musical: The Musical: The Series or Big Shot—earn a top ten spot on the Nielsen rankings. Could Monsters at Work break that trend?

- Speaking of PVOD/SVOD releases, Disney has a big film this week. Black Widow. Coming to theaters and PVOD like Raya, an MCU franchise film is the closest thing to a known quantity in entertainment and it’s not crazy to assume their first blockbuster in two years could shatter both PVOD and SVOD records. And theatrical ones too.

Of course, looking at trends, this graph surprised me:

Hmm. Well, this is either an example of Google Trends failing us, or an MCU film under delivering to expectations. Looking at box office tracking data, Black Widow currently has the highest “will see” rating of films currently tracked—a great sign—though it has lower awareness than F9 did at the same point. We’ll see on Friday.