Here’s a 7 Point Plan to Save Hollywood Workers and the Marketplace

The Most Important Story for 14-Aug-2024

(Welcome to the “Most Important Story of the Week”, my bi-weekly strategy column analyzing the most important (but often not buzziest) news story of the last two weeks. I’m the Entertainment Strategy Guy, a former streaming executive who now analyzes business strategy in the entertainment industry. Please subscribe.)

Today’s article is free for all to read. If you’d like to cross-post it to your newsletter, feel free!)

Several years back, in one of my most prescient predictions, I speculated that “antitrust”—meaning renewed antitrust enforcement after about forty years of lax enforcement—could become the new “deregulation”, as in a movement that could change the economic order. Now, for that prediction to come true, it required President Biden to win the presidency and then nominate strong enforcers of antitrust law into roles in the government. Both things came true. (I went over the odds of that happening here. In short, it was not very likely.)

Last week, we had huge news on that front. Google lost its first antitrust trial, and a judge ruled that they are, indeed, a monopoly.

I guess August is for antitrust. (Rereading my past writings on antitrust, they all seem to show up during August.)

I can’t undersell the potential impact this story could have on the future of the entertainment industry. Yes, it is about “Big Tech”, but Big Tech is playing a huge role in the entertainment industry. The potential breakup of the owner of YouTube is big, big, big news, and the trades (and the constellation of pundits discussing entertainment business news) barely covered it!

This actually pairs well with two other stories I had my eye on over the last few weeks:

A judge overturning the NFL’s loss in the NFL Sunday Ticket Antitrust case.

A controversy surrounding Reid Hoffman, who donated to Presidential Candidate Kamala Harris’ campaign, arguing that Harris should fire FTC Chair—and antitrust superstar—Lina Khan.

Combined with the big, big, big Google news—sorry for mentioning it again, but it’s huge—antitrust is clearly the story of the last few weeks. So it’s the “most important story of the week”, and I’m turning this entire issue over to that one topic.

Most Important Story of the Week - How Antitrust Could Come For Hollywood…And Make Everything Better

I’ve been on “pro-competition” since I went to business school. Indeed, I feel strongly that our economy, in general, and our industry (Hollywood), in particular, needs competition more than ever.

That’s the case I plan to make today, one long article dedicated to antitrust. I want to convince as many people in Hollywood to join me in protecting markets, especially since it’s the most pro-worker policy out there. If we want a better Hollywood, we need a more competitive Hollywood.

In this article, I’ll...

Review the most important question to determine how we structure the entertainment industry as a market.

Explain three economic concepts (in simple, layman’s terms) to show why industry consolidation is bad.

Show how Hollywood is consolidated horizontally and vertically…

…and why giant platforms extract rents/create dead weight loss in our industry

Most importantly, I’ll offer six solutions for how to fix these problems.

Part I: The Key Question

Looking at Hollywood, I can ask a (hopefully) simple question to set up everything that follows:

When it comes to the value created by the entertainment industry, who should receive that value?

(I prefer to use “value” in this context since it captures intangibles more than “profit” or “money”. If value is confusing, just think “profits” instead. Or ask, “Who should get paid?”)

Most folks would answer one of two ways:

The creators/talent who make great movies and TV shows.

The consumers who watch it.

In other words, the consumer/movie-goer/TV watcher/user gets value watching a movie, video or TV show, and the creators of that content deserve to get paid for making it.

Given the strikes of the last year and consumer dissatisfaction with high prices, ask yourself, does that seem like that is where most of the value is going?

I don’t think it is. While some talent does get paid very well, Hollywood workers have been buffeted by economic forces. Meanwhile, Hollywood executives do make more than ever. That was the core issue of the strikes last year. Prices have come down for consumers, but Americans pay some of the highest prices for TV/film in the world and rising streaming prices are getting close to the levels of the old cable bundle. So I think the intuition of most people is right: the profits from video content should go to creators/talent and consumers.

The question is how we make that happen. And that comes back to how we structure markets in America.

Part II: Hollywood’s Core Problem Explained in Three Economic Concepts

To explain both the need for strong antitrust enforcement and the particulars of why it’s needed in Hollywood, I need to explain three related economic concepts.

No, don’t run. I promise, they’re easy to understand and explain the problem quickly and easily.

Three Key Economic Concepts

First, here’s the most simple explanation of why we need antitrust. For a market to function, it needs many buyers and many sellers. That’s Econ 101 stuff. The key, then, is multiple sellers and buyers. Anytime a market gets too consolidated, the “many sellers” part atrophies. Here’s an example of a chart showing monopoly pricing power at work:

Again, this is very basic economics knowledge. Any defender of market power needs to start by explaining why this basic point is wrong before they even start defending consolidation.

Second, I prefer to talk about “value creation” versus “value capture” when it comes to business strategy. I wrote about this theme in one of my first articles, but to summarize, when a business innovates, it creates value in one of two ways: it increases the willingness to pay for its customers, or it lowers its costs by finding more efficient ways to offer its product.

“Value capture” on the other hand happens when a company identifies ways to increase prices or lower costs without innovating. For example, say you corner the market on a drug (like insulin), and raise prices 600%. That’s not creating value; that’s simply capturing it.

This can also apply to costs: if you simply have market power as a seller (say you own the dominant search engine, social media platform, or e-commerce website) and you insist suppliers sell you their goods for increasingly lower prices. Or you won’t let them sell for lower prices on other websites. Or force them to advertise on your website. In those cases, the businesses aren’t actually creating value; they’re taking it from their suppliers.

When it comes to monopoly considerations, more discussions should mention value creation versus capture.

Lastly—and here’s the key part for Hollywood—for any industry, one must consider the “value chain”, the series of businesses or steps required to make a product. I often use potato chips as the example that you need potatoes from a farmer, to a chip maker, to a distributor to a grocery store to get to a customer:

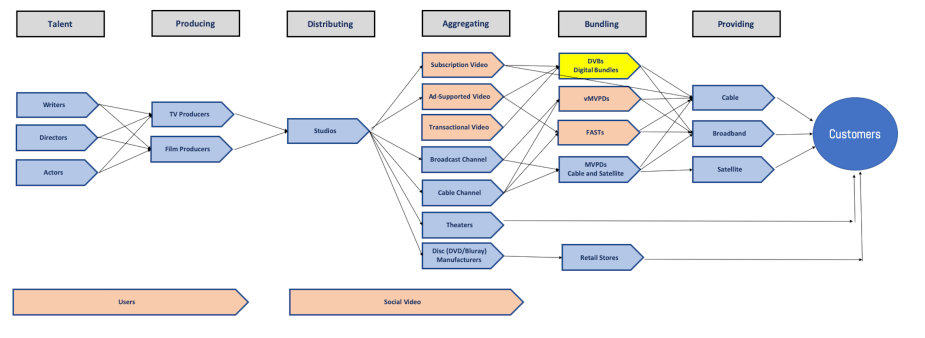

I’ve made a complicated version of this for the entertainment industry with multiple layers I call the “video value web”, but we can put it here to see the rough five levels:

At each step of the value chain, a business should create value for the final product. The farmer grows the potato, the chip maker turns it into a chip, the grocery store makes it available locally, and so on.

The Key Problem: Moats, Bottlenecks, Aggregation, Attractive Profits, Dominance, and Scale

You might have noticed, up above, that I didn’t explain how the distributor added value to the potato chip. Presumably, a distributor brings expertise in logistics, though unfortunately, in reality, it often means acquiring market power to extract value. In everything from shipping to pharmaceuticals, distributors often acquire market power, then extract rents from suppliers/producers or consumers or both.

Using “distribution” is deliberate, because the entertainment industry uses the same word…and lots of folks would accuse those distributors of extracting rents too. In entertainment, a lot of value gets captured in the middle of the supply chain, by distributors, aggregators and bundlers.

Why does that happen? Because business leaders know that’s how you can capture lots of value. And capturing value is often much easier than creating it.

Perhaps the most eloquent description comes from Ben Thompson’s discussion of Clay Christensen’s theories: the law of attractive profits. In his telling, you analyze an industry and identify either by disruption, bundling, or unbundling the part of the value chain where you can capture “attractive profits”, meaning higher profits than everyone else in the value chain.

The problem is this is often done through acquiring market power.

And the description of this market power usually uses any word besides “monopoly” or market power to describe it, since those have legal meaning. Linked-In CEO Reid Hoffman wrote an entire book on this, but used the word “dominant” instead of “monopoly”. Warren Buffett uses “moats”. Lots of tech boosters say “scale”, “aggregation” or “platforms”. Private equity uses the term “roll up”. In some cases, for example, venture capitalist Peter Thiel has just straight said he wants more monopolies.

How do you grab those attractive profits? By corrupting one of the economic tools above. Boiling it down, three tactics allow for those attractive (read monopoly) profits:

Horizontal consolidation

Vertical integration

Platform dominance

Hollywood has a problem with all three.

Part III: Hollywood’s Quick History of Consolidation

So that’s the economics lesson, now we move onto the specifics of our industry, tinsel town née Hollywood née “the Business” née the entertainment industry.

Horizontal Consolidation

In antitrust language, a horizontal merger is when companies merge within a specific part of the value chain. They merge horizontally to acquire market share and hence power.

One of my hot takes on Hollywood and antitrust is that the horizontal consolidation problem isn’t actually as severe as other American industries. For example, the healthcare industry has seen hospitals merge to increase their buying power against insurers, who merge in response, and against pharmaceutical companies, who merge in response. It’s horizontal mergers everywhere. Wireless companies—where only three (3!) companies control the market—are also fairly consolidated. Don’t forget Google, which owns a whopping 87% of search engine traffic in America.

That said, Hollywood too has its own consolidation problems. The most egregious are movie theaters, which are basically down to three major chains, and a lot of indie players. Here’s a chart of total screens in the US over time by the top ten chains:

The agencies have also kept consolidating, and this likely extracts rents from talent too. I can’t stress this one enough: as agencies have kept consolidating, they acquire more and more power over talent and projects in town. While many agents and managers deliver incredible amounts of value to their customers, when they acquire too much power that’s at risk.

The other fun mini-monopoly is the industry trades, as one company controls four major trades (Variety, The Hollywood Reporter, Deadline, and IndieWire, along with other companies like Rolling Stone and Billboard. Support independent media!)

The only good news is that the biggest monopoly in the American entertainment industry is slowly atrophying, the MVPD or cable/broadband/satellite monopolies on TV distribution. Cable has always been a series of local monopolies without choice for consumers. The internet has intermediated the distribution of TV channels, which is showing up in cord-cutting statistics.

The caveat? Cable companies still control local internet connections, which are vital to watching digital video. The good news is local cable monopolies will go up against increasingly powerful cellular internet connections, but as I mentioned above, there are only three major cellular phone companies.

Vertical Integration

Let’s move to our next problem, vertical integration. Hollywood’s problem with this—again, not a problem if you’re part of one of the large companies—is that vertical integration started back in the 1980s and 90s and then continued apace. Studios bought linear cable channels, and then broadcast channels, and then even cable companies started buying movie studios.

Honestly, if it weren’t for a strong warning to not own theater chains—an old school antitrust ruling known as the Paramount Consent Decree, which got overturned during the Trump administration four years ago this month—those likely would have been snatched up too. So large entertainment conglomerates are a problem too, and self-dealing is rampant. Everyone has heard stories about studios and networks making deals to undersell profit for talent participants. Or shows that were renewed despite having lower ratings than shows that were cancelled, because the network/conglomerate owned one but not the other.

Hollywood used to have a thriving market. Every studio had to sell to every other channel, since they couldn’t exclusively broadcast their own stuff. Compare that to today, when the streamers make their own TV shows for themselves. There’s no market and very little resale. (Compare this to the era of syndication.) As Matt Stoller has shown, limiting ownership helped cause a boom in UK TV production.

Again, limiting vertical integration essentially adds more buyers and more sellers to the marketplace for content. That’s good, sorry, great for talent.

Big Tech and The Rise of Platforms

In the 2010s, vertical integration got even worse. Specifically, the internet made it much worse.

The growth of the internet resulted in the increasing importance of “platforms”, meaning single access points that either benefited from network effects or demand-side increasing returns. This resulted in “natural” monopolies. A few companies owned these platforms, and they extracted outsized returns from their ownership—meaning they have low operating costs, but huge revenues, and hence outsized profits.

They became known as “Big Tech”, and when Big Tech had tapped out its profit margins, they expanded to other industries, the more adjacent to technology, the better. Video was a prime example, so Google, Amazon and Apple all compete with traditional entertainment conglomerates, yet have huge profits from other lines of business to support losses, if need be.

Unfortunately, having Big Tech companies entering the video space without any concern for losses distorts the entire market. It means more efficient firms lose out to worse-performing companies, which is bad for customers. Worse, longer term, is what happens if the Big Tech streamers can successfully drive more traditional studios out of business, and then gain market power over talent.

Just ask newspapers how their early 2010s alliance with Google and Facebook ended up working out for them.

The Simple Solution? Break Up the Industry Horizontally, Limit Vertical Integration, and Limit Any Platform’s Power

Having sketched out Hollywood’s general consolidation, and pointed out the specific ways that these give the people/companies in the middle of the value chain market power to capture exorbitant profits, the solution is relatively easy to lay out. We just need to stop horizontal consolidation, limit vertical integration with smart regulations, and break up Big Tech.

Of course, saying this is easy; implementing it is something else; it’s the old strategy-is-easy/execution-is-hard debate.

Still, I’d provide seven ways to restructure the entertainment industry:

A Seven Point Plan To Save Hollywood

Eliminate any parts of the value chain with horizontal consolidation. More competitors leads to lower prices. Most of the theorizing about economic efficiencies and economies of scale hasn’t borne fruit. So consolidation in theaters, talent agencies, industry trades, broadband and cellular distribution, and elsewhere should be addressed by antitrust enforcers.

Bring back the “FinSyn” rules for the 21st century. Short for “financial syndication”, this meant that broadcast networks couldn’t own the majority of shows airing on their channels. A new rule like this would force the streamers to buy from third-party producers, which would be a boon for talent. It would also likely improve the quality of shows, since it would lead to a much more competitive market.

Severely limit vertical integration, especially if different parts of the value chain can create value for customers. While we’re at it, put in rules that any distributor (think Apple, Amazon, Google and Roku) can’t also own a streamer. That would avoid conflicts of interest on app stores, and level the playing field. This avoids the temptation to extract profits in one part of the value chain at the expense of another.

Cap platform taxes everywhere. Apple charges people 30% to sell things in its app stores. Google and Amazon and Roku too. (Though they do provide tax breaks to very large corporations in a surprisingly regressive tax move.) These taxes on businesses are just ridiculously high, which is why all the stores have such high operating margins. These caps would flow directly to either streamers (to spend on content) or to customers (in terms of lower prices). Given how little Apple and Google spend on their app stores—again look at the profits—you’d hardly notice a change in the stores, except for lower prices.

Oh, break up Big Tech, especially the video platforms. I don’t know if Apple TV+ and Amazon’s Prime Video make money, but I’d love for them to exist on their own to compete in the market on their merits. Same for YouTube, which benefits tremendously from Google search traffic. So if the above rules preventing vertical integration don’t happen, we should still break up Big Tech to make everyone compete on the same playing field to woo customers.

Break up entertainment conglomerates. Yeah, I’m going there too. The above rules would encourage breakups among the production and streaming arms of entertainment companies, but if not I’d explicitly do that too. I’d also break up the movie theater chains to spur innovations in that small part of the ecosystem. Oh, the agencies too.

Address piracy and IP theft. Once Big Tech has less political power, mandating that platforms stop promoting pirated content seems like an easy policy to demand.

That’s how you structure the markets to make the more competitive Hollywood we need. But for specific tactics, here’s what I’d recommend:

Keep Lina Khan and Jonathan Kanter in their jobs if Democrats retain power. They’re doing a lot of great work already. If the FCC isn’t on board with this agenda, consider changes there too.

Focus on separating YouTube from Google as a start. Given the evidence in the case that Google prioritizes its own internal businesses, YouTube likely has a tremendous search advantage over rival video streamers. If true, that distorts the market. The only way to ensure competition is to break them up.

The Hollywood Unions and Guilds need to put competition and antitrust on the agenda. They also need to tell their members to bring up breaking up Hollywood and Big Tech as often as possible. It’s the key to competition, which is the key to a better entertainment industry.