My (Initial) Thoughts on the Netflix Data Drop, Plus The Crown Struggles, Swing to Survive Misses, and More

The Streaming Ratings Report for 15-Dec-2023

(Welcome to my weekly streaming ratings report, the single best guide to what is popular in streaming TV and what isn’t. I’m the Entertainment Strategy Guy, a former streaming executive who now analyzes business strategy in the entertainment industry. If you were forwarded this email, please subscribe to get these insights each week.)

Hollywood notoriously takes a lot of time off in December, and I’d say that we’re firmly in the holiday vacation season at this point, if not for everyone, then a lot of people.1 The pace of news has slowed down, schools have already started going on break (at least LAUSD has), and a lot of people have left or are leaving town this week. (And that includes me!)

That means we’ve got one last Streaming Ratings Report of the year for you. I wanted to go quick with today’s issue…but you want to hear my thoughts on the big Netflix data drop, don’t you? Plus we finally got ratings (or should have gotten ratings) for The Netflix Cup: Swing to Survive, so this week is brimming with content.

There’s no Streaming Ratings Report this Friday, but I’ll have a few other articles and unlocked pieces to tide you over for the holidays (since my paid subscribers overwhelmingly told me, via last week’s poll, that it was okay). When we get back in January, I’ll have a two Streaming Ratings Report “double issues” for you to catch up on everything.

Finally, I want to give a big thanks to everyone who’s subscribed to this newsletter, paid or unpaid. Just last week, I crossed 10,000 subscribers! Thank you!

Say what you will about modern media, but the fact is writers like me (or me and my editor/researcher) can make a living writing in-depth pieces on streaming ratings that wouldn’t have been possible in the old media ecosystem really. That wasn’t possible in the old system.

(Reminder: The streaming ratings report focuses on the U.S. market and compiles data from Nielsen’s weekly top ten viewership ranks, Showlabs, TV Time trend data, Samba TV household viewership, company datecdotes, and Netflix hours viewed data, Google Trends, and IMDb to determine the most popular content. While most data points are current, Nielsen’s data covers the weeks of November 13th to November 19th.)

Data - My Thoughts on the Big Ol’ Netflix Six Month Total Hours Global Data Drop

The big data news of the last week—heck, it might’ve just been the biggest news of the week period—was Netflix dropping what they call an “engagement” report, but I’d call a “viewership summary”.2

And what a summary it was. As they note, they provided data for 18,000 titles, basically any title customers watched for more than 50K hours in the first half of 2023. (They rounded up to the nearest 100K hours.) Whenever you get a new data set, I always recommend clearly laying out a straightforward “Data 5Ws”, which, as a reminder, is simply the who, what, when and where of the data. (The “why” is for interpretation, and some Ws get repeated.)

Here they are:

Who - Netflix

What - Total Hours Viewed

What 2 - By TV series, Special or Film

Where - Globally

When - From January to June 2023

A lot of people thought I’d be pretty thrilled to get this much data, but I’m probably less excited than you’d guess. I don’t think this data set, as constituted right now, really tells us that much more than we already knew. It really drives home one huge point, but after that, it’s sort of, “Oh, this data has a TON of caveats.” You know me, I try to make everything “apples-to-apples”. As it stands, we can’t do that for most shows in this data set.

Nearly every newsletter I read talked about this last week, and I’m not sure I have much more to add strategically, to be frank. But I still haven’t seen a strong enough discussion of the limitations and potential upside of the data. Let’s start with my biggest take.

This Data Illustrates the “Logarithmic” (Or Power Law) Distribution of Returns in Streaming

If you can only read one article I’ve ever written, I’d recommend this gem from way back in the first year of this newsletter/website. I tried to explain the basic idea that in entertainment, returns (meaning performance) is not linear or “normal”; it’s logarithmic. Meaning that hits—hit films or hit TV shows—aren’t a little bigger, but multiples bigger than everything else.3

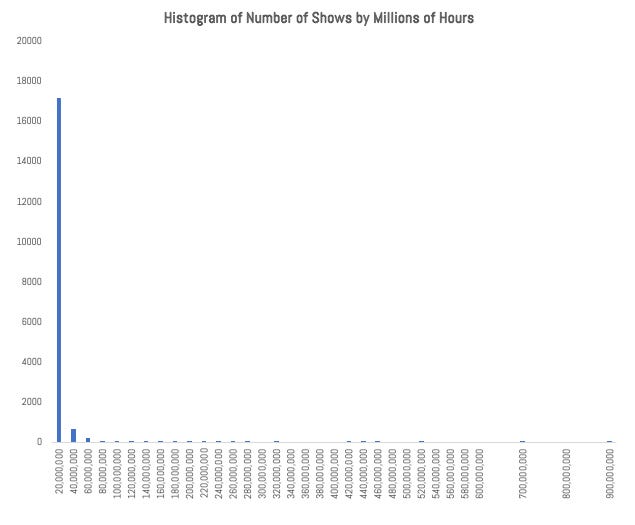

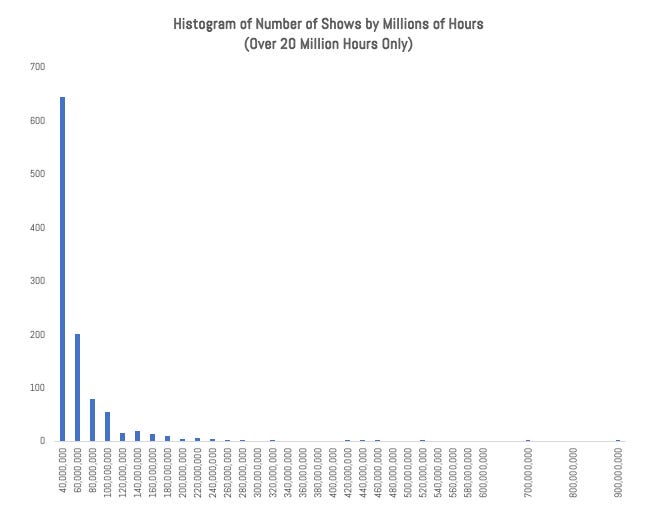

Netflix’s data drop proves what I knew to be true in my experience, but couldn’t prove yet with public data sets in streaming. Well, now you have it. As others pointed out, the top 1,000 shows and films account for 60% of the viewership. Meanwhile something like 3,800 shows or films had less than 100K hours viewed. Something like 8,300—nearly half!—the shows got less than 500K hours viewed.

This data is logarithmic! Let’s zoom in slightly more to make it clearer:

This is a good reminder that, once again, this is a hits driven business. And if you quibble over which show “won” among shows in the top ten or top twenty or top 100, it mostly doesn’t matter compared to the multitude of shows ranking well below that elite tier.

The hits drive multiples more viewership than the flops.

The Limitations of this Data Set

As a head’s up, I plan to dive into the data in 2024, since I tend to take data projects a bit slower than a lot of news outlets. (Frankly, this much data came out the week before Christmas break and all my research/writing time had already been allocated; I didn’t have the time.)

I’d rather be comprehensive than fast, if that makes sense. For example, I’ve already seen a number of articles, if not dozens, searching for specific genres or types of films and trying to draw conclusions. Some people have done this well (like Sean McNulty just today) but many others, which I won’t call out, feel, let's just say, less than informative.

Comprehensiveness takes a LOT of time.

That said, the data set really isn’t that complicated; it’s just four columns. As such, without personally diving into the details, I feel safe saying I don’t think this data set will be that immediately useful. Let me quickly explain why:

First, the biggest problem is accounting for number of territories a given title is distributed in. For example, Paw Patrol: The Mighty Movie made the Netflix English language film charts a few weeks back. Do you know how many and what countries that title is distributed in? Because I don’t! The biggest challenge in drawing meaning from this data is understanding exactly how many countries a given title streamed in…

…Or for how long! This is only six months of data, but a lot of the titles at the top of the charts came out throughout this six month period, thus for different lengths of time. To draw meaningful conclusions, we have to account for that. As others have pointed out, that’s why Netflix’s top ten weekly charts are probably more useful for now. Netflix did provide release dates, but most analysis I’ve seen ignores that fact.

Third, Netflix’s top ten lists really do provide the bulk of a given title's viewership. If a show doesn’t make one of those four lists, it probably underperformed. This list expands what we know, but not by that much.

Fourth, this is a global data set, and we still don’t have country-by-country viewership. Indeed, on one call Ted Sarandos reportedly even laughed at the idea of providing country-specific data since it would give away their “secret sauce”. I tend to agree that the streaming wars really are fought one country at a time.

Fifth, since this is just Netflix data, we don’t know what to compare it too, besides Netflix itself. The next best would be streamer-to-streamer comparisons. Yes, Netflix would still dominate, especially other streamers, but at least we’d have some point of reference. When it comes to data I want, more Netflix viewership isn’t what I need. (Though, yes, I’ll still take what we can get.)

Sixth, and probably most importantly, we only have six months of data here. How do these shows compare to other six months intervals? We have no idea. Presumably, though, when Netflix keeps releasing this data, we’ll be able to build an entire data set and draw some conclusions. But that won’t be until they release a report this time next year.4

Being honest, the limitations of the above data is probably why I won’t dive too deeply into this data. I’ve been laser-focused on US streaming ratings, and until global viewership has as much detail as America, I’ll stay focused on it.

The Upsides of This Data

Still, more data is always better. Let’s not look this gift horse in the mouth. (What is a gift horse?) In particular, we can now really understand how well some “dogs not barking” performed globally. We can put actual numbers to it and, again, a year from now, we’ll have a year and a half of data to compare it to. (Though it would be great if Netflix backfilled us with this data going back at least a few years to provide comparisons.)

I can think of two great uses. First, we’ll be able to understand a bit more how licensed, acquired and/or library titles perform. Again, a lot will depend on how many countries those shows stream in (a tough nut to figure out as many titles bounce around) but at least we have that data for a lot more shows.

Second, and probably best, we’ll get a lot of data on “decay” rates for shows. Meaning we can understand just how much viewership takes place after titles drop off the top ten list. This will get even better, again, with 18 months or more of data.

So did you pick up on the theme? More time intervals is really what we need to make this data useful. This is a start..but just a start.

More to Read

If you want some good takes, Sean McNulty had two good ones. He takes issue with Netflix providing “hours viewed”, and while I am fine with hours, he’s right that providing views would have been great too! He also looked at some film takeaways here, including how well the Sony films and stand-up specials have performed. Friend of the newsletter Emily Horgan had some quick kids content thoughts here as well. The folks at Across the Movie Aisle also discussed it this week. Last, Julia Alexander looked at the data for Puck here.

Television - The UK Invasion…Sputters?

Do you remember when Netflix binge-released their shows? What a time. Back then, Netflix released everything all at once, usually on Fridays and this was—remember back then—the smartest way to release shows. Even expressing skepticism of the binge model was a sign you “didn’t get it” and Netflix did. Customers wouldn’t stand wait for their TV shows anymore. Get out of here, Luddite!

And yet Netflix only released FOUR episodes of one of their biggest shows, The Crown, on Thursday 16-Nov. They’re making customers wait—can you imagine waiting for TV episodes!?!?!—until December for the last six. And as such, it didn’t break my (unofficial) 20-million-hours-success threshold:

Only 15.7 million hours! But last season debuted to 35.5 million hours. But comparing it to past seasons is fraught, since past seasons debuted with ten episodes respectively (and season four actually started on a Sunday!):

Or is it? I mean, Samba TV tracks unique households, and you can see that the current season only debuted to 780K households, down from 1.2 million last year:

Given the smaller number of episodes, I think the decline in total hours isn’t that worrying. While the Samba TV numbers show that some decay has happened, it’s not that worrying for a show in its sixth season. Fans love the show—it has elite IMDb scores of 8.6 on 243K reviews—and frankly, the “batched”-style of release will actually help keep customers on Netflix longer.

Quick Notes on TV

Netflix’s The Criminal Code—whose vague sounding logline I joked about when I wrote about foreign films for The Ankler—made the charts this week with 5.6 million hours. Again, it’s good to make the charts, but its low total hours is in line with most foreign titles. The Santa Clauses, which came out on Wednesday 9-Nov, missed the top ten charts. However, it barely missed the charts this week, coming in 11th place with 4.0 million hours. As we round into December, I have a feeling that The Santa Clauses will make the charts a few times. Just beating it at tenth place, Prime Video’s animated series Invincible, which finally made the Nielsen top ten lists in its third week. As I noted last week, Invincible did great on Showlab’s Prime Video charts. As a reminder, like The Crown, the latest season also debuted with four episodes. (Four episodes is the new binge release…)

Speaking of animated TV series, Netflix released Scott Pilgrim Takes Off, an anime spinoff series in the Scott Pilgrim universe, which I’m sure I don’t have to explain what that is to my readers. (Fine, it’s based off the film Scott Pilgrim vs. the World film, which was based off the indie comic Scott Pilgrim, both of which Wikipedia describes as having a “cult following”.) It missed Nielsen this week, but made the Showlabs Netflix chart:

The Thursday Night Football game this week actually featured good teams for the night of 16-Nov, so the ratings ticked up. As a reminder, this was the biggest “thing”—show, special or film—on streaming this week, only counting live viewership.

The biggest new show of the week in terms of budget was probably Apple TV+’s Monarch: Legacy of Monsters, which is set in the Godzilla universe. (Why not put “Godzilla” in the title then? Good question!) Did you know this is the sixth installment in Legendary/Toho’s the “Monser-verse”? I follow nerd stuff like this for a living and I didn’t. Snark aside, I have a feeling that this title may end up being one of Apple’s biggest first seasons of all time. While it missed Nielsen this week (reminder, the week starting 13-Nov), it makes Samba TV’s top ten charts the week of 20-Nov. Given Apple TV+’s small size and that they only released two episodes its first week, missing the charts isn’t too surprising. It’s IMDb scores are okay (a 7.2 on 13K reviews). (While we’re at it, Netflix’s How to Become a Mob Boss makes the Samba TV charts the week of 20-Nov, so we’ll hold off calling that one a miss until next week too.)

We got another Disney+ datecdote in November, this time about Loki’s second season. Disney said that the series “consistently hit” about 11 million views per episode.

Overall, the TV charts stayed relatively quiet and calm again. All The Light We Cannot See dropped again, as did Life on Our Planet and Selling Sunset. Docu-series Escaping Twin Flames was flat and The Great British Baking Show made it for another week.

We had another show from Hulu that made the TV Time “Interest” charts, but has so far failed to pop on Nielsen or Samba TV’s viewership trackers. That’s A Murder At the End of the World, which debuted on 14-Nov. (Fun fact: This show was initially slated for August, but Hulu rescheduled to November.) Based on its IMDb reviews—a 7.4 on 7.5K reviews—I don’t think this show will end up making a viewership charts. Both Apple TV+ and Hulu often have shows make the TV Time charts for weeks, but never the Samba TV or Nielsen viewership charts. It’s still good they drive interest…but even better if that interest translated into viewership. Still three weeks on the TV Time charts is good enough to avoid a “Dog Not Barking” fate.

Oh, and here’s another branding tidbit: A Murder at the End of the World is branded as “FX”, not “FX on Hulu”, making me wonder if that branding is done. It’s also, as you can see from the key art, clearly branded as a Hulu Original:

The miss/flop of the week is the second season of Max’s Julia, which had three new episodes come out, but failed to make any—any!—of the streaming ratings charts that I track, including the Showlabs Max charts, which are a top five for just Max. This feels huge to me. Not to be too hyperbolic, but Julia might be the last show of the streaming ratings era that truly benefited from a lack of ratings. Now that we have its ratings, it’s pretty safe to say that almost no one is watching this show, but here’s a headline calling it a hit show...

Other misses and “Dog Not Barking” (my term for any show that doesn’t make any of the ratings charts that we track, find an explainer here.) of the week include a host of Hulu shows like Hulu’s sports docu-series Brawn: The Impossible Formula 1 Story (proof, once again, that F1 isn’t as popular as a lot of people think), Hulu’s reality show Love Island: Australia and two docu-series The Secret Life of Dancing Dogs and Drive With Swizz Beatz from the Onyx Collective. (Why did Hulu release so many shows in the same week?) Misses from other streamers include Cocomelon Lane on Netflix (I usually don’t include kids shows, but this is Cocomelon we’re talking about here and a recent report said that Moonbug didn’t make as much money as it was supposed to), Peacock’s House of Kardashian (proving that the Kardashians aren’t as popular as many people think) and Prime Video’s reality show, Twin Love.

I can confirm that all of last week’s DNBs, including Apple TV+’s The Buccaneers, Paramount+’s Colin From Accounts, Prime Video’s 007: Road to a Million, and Max’s Rap Sh!t.